Effortless Integration and Secure Transactions Transform Crypto Assets into Real-World Funds

Overview

Euvic developed a robust platform for a fintech startup that allows cryptocurrency owners to borrow regular money without needing to sell their assets for a fintech startup.

- Delivered in just 4 months while empowering the fintech startup to focus on its core operations

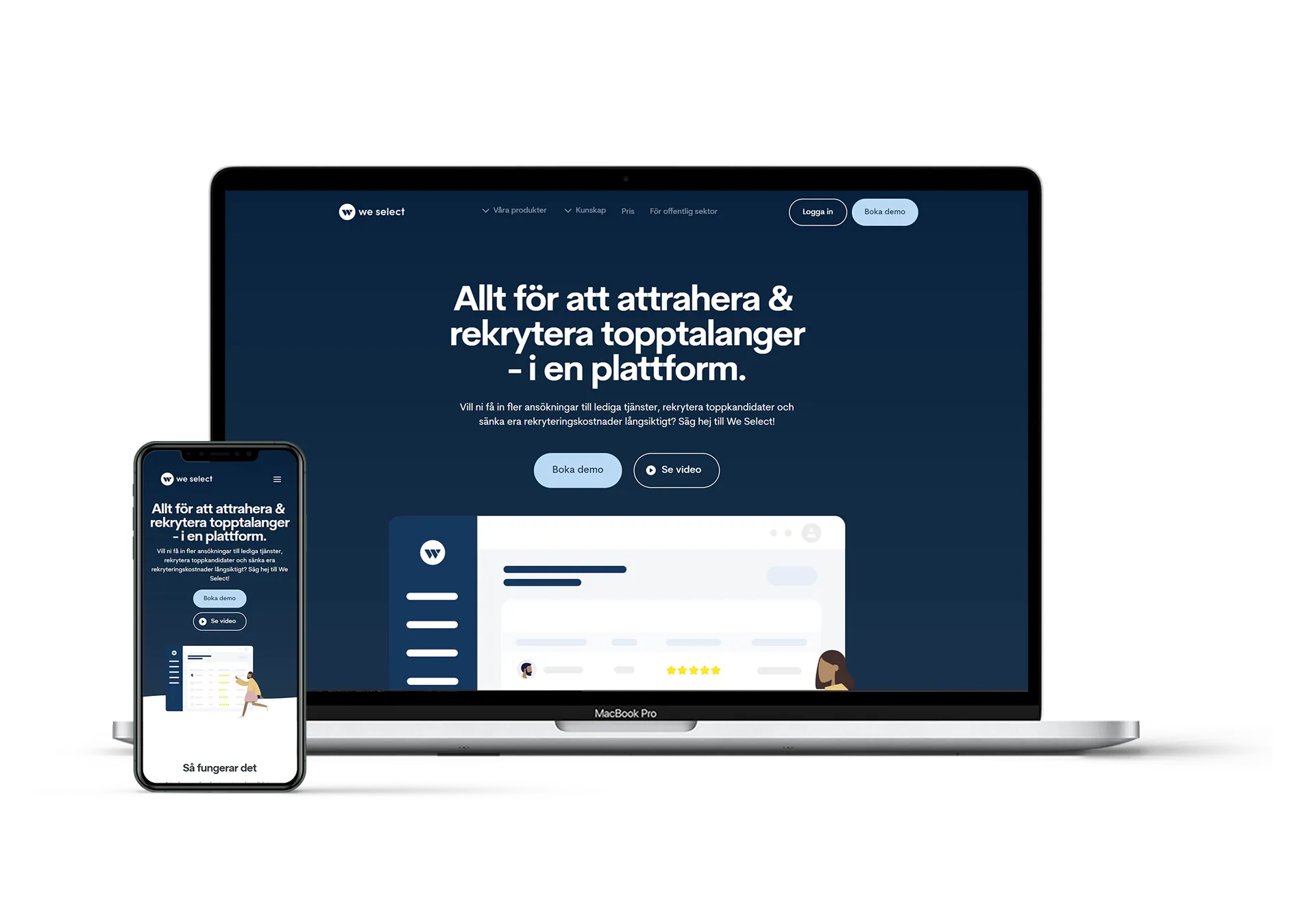

- Delivers an easy interface that integrates smoothly with any dApp.

- Combines traditional banking practices with modern digital finance

- Ensures strong security and favorable loan conditions

- Enables users to lend or borrow funds using their digital assets and to manage assets, track loans, and earn interest

[Client under NDA] This client is a benefits engagement platform that connects the complex ecosystem of employers, employees, product providers, and consultants to make benefits easy to understand, personalized, and simple to use. The company is on a mission to help financial advisors better serve their customers and get better results from retirement planning.

This small and nimble startup provides a service where people who own cryptocurrencies like Bitcoin can borrow regular money, like dollars, without having to sell their cryptocurrencies.

The service blends traditional banking with new digital finance methods, ensuring security and good loan conditions. The software they use is advanced, allowing users to borrow money against their crypto or lend their own money to others.

Users can use special digital tokens from decentralized apps (dApps) as a form of security to earn interest by lending money to others. The platform where this happens can be easily added to any dAPP, regardless of its size, using a simple setup tool (API).

The company had established a go-to-market strategy and marketing program that had already built an audience through forums, blogs, and community websites.

- The company had only created demo versions of the product and didn’t have a live version that was ready to sell.

- As demand grew, the urgency to create an MVP launch of the platform was increasing.

- This client needed a seamless and user-friendly digital finance platform

- Users needed to easily track transactions, access market data and loan history, and customize their experience

- The platform needed to maintain the speed and flexibility necessary to efficiently manage purchases, sales, and exchanges.

- The fintech startup needed to move quickly to capitalize on market conditions and outpace competition.

- The firm did not have the in-house diversity of skills or the capacity to design, build, test, and deploy the platform.

The company contracted with Euvic, and quickly onboarded its nimble expert team to deliver the solution. Euvic was able to scale and onboard technology, UX, and development experts as the project demanded, all under an aggressive timeline.

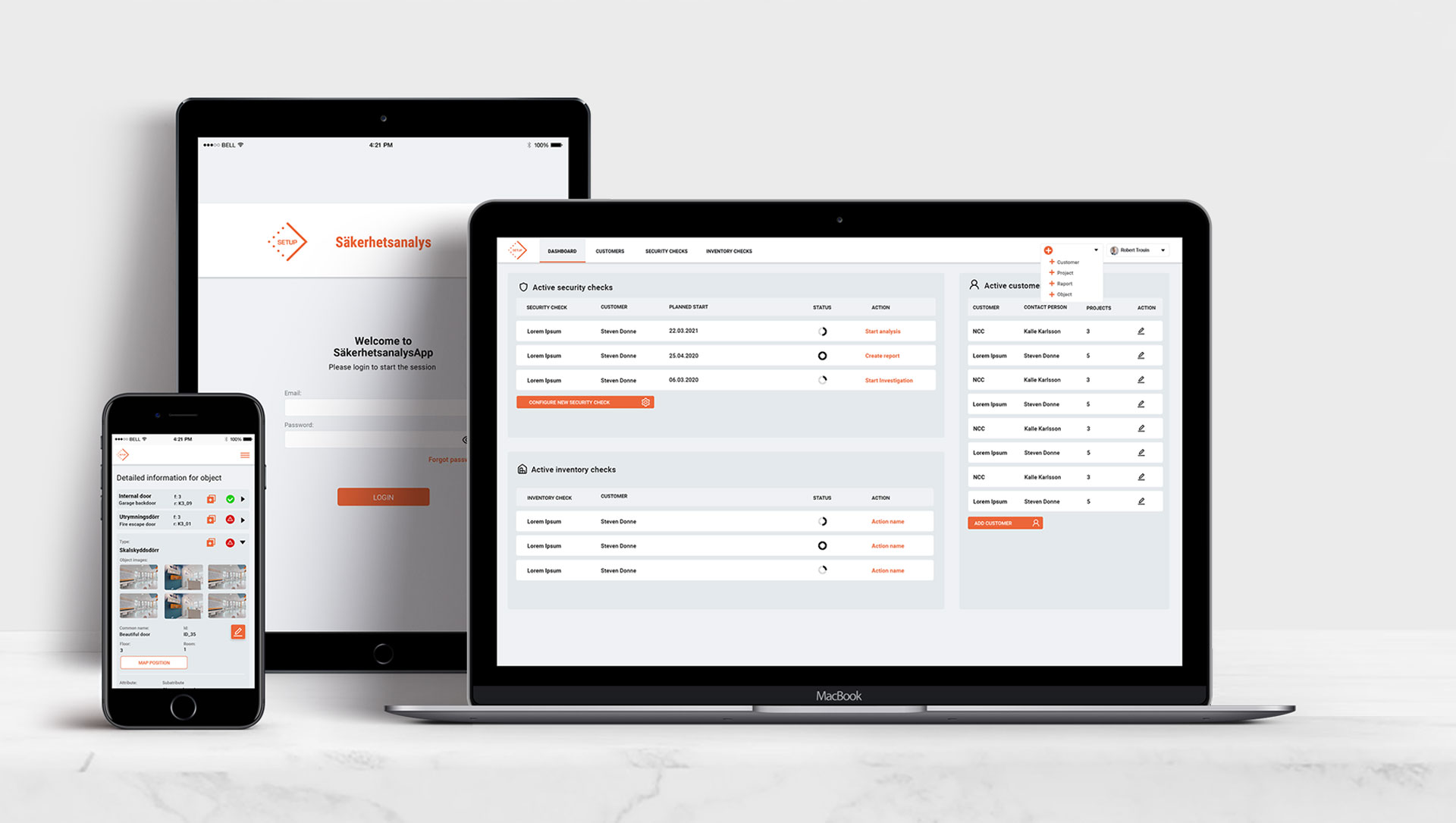

Moving with urgency, the team designed a platform that helps users manage their digital assets, easily check the market, view past loans, and see statistics through their account. The platform also uses a smart system that allows users to quickly buy, sell, or exchange crypto assets in a way that fits their individual needs.

Platform Functionality Includes:

- Digital Asset Evaluation and Assets-backed Loans: Allows crypto owners to borrow regular money using digital assets as a guarantee. The system uses an algorithm to check the value of their digital assets and offers loans based on their worth.

- Marketplace Opportunities: Lets users borrow or lend money using digital assets. Borrowers get the funds they need while lenders earn interest.

- Solid Security: Keeps users’ digital assets and money safe using security measures like multi-signature wallets and cold storage.

- Favorable Loan Terms: Gives borrowers good loan deals, like low-interest rates and flexible repayment options.

- Integration with dApps: Can integrate with any dApp using a simple setup tool (API), making it easy for users to access.

- Earn Interest: The system checks how reliable borrowers are and sets the right interest rate for lenders.

- User-friendly interface: Has an easy-to-use interface where users manage accounts, check loans and interest earned, and track digital assets.

- User Verification: May ask users to complete a transparent ID verification process to make sure they meet the platform’s requirements and comply with regulations.

- Collateral Management: Includes collateral management services to prevent risks associated with digital assets’ value fluctuations. This includes automatically selling the collateral if the value falls below a certain threshold.

- Loan Application: Users can create a loan application with flexible terms and loan amount setup, allowing them to choose the loan amount, interest rate, and repayment period that suits their needs.

- Early Repayment: Borrowers can make early loan repayments without penalty.

- Native Token Minting and Distribution: Offers a native token in the ERC-20 format, which users can use to access platform services, earn rewards, and pay for loan fees.

Euvic clients have access to the group’s many Centers of Excellence (CoE), and can leverage the specialized expertise and capabilities of each CoE based on individual project needs. As a result, we can offer our clients deep expertise across a broad range of solutions. In this case, Euvic’s client was served by our CoE, Artkai, which excels in user experience design.

Euvic was chosen because of our deep bench of experience in the finance and fintech industry. The project’s dream team included: 2 UI/UX designers, 3 Front-end engineers, Back-end engineer, Software Architect, Project manager, Business analysts, DevOps, 3 QA Engineers.

Euvic delivered an advanced platform that lets users access funds without having to sell their digital assets. Blending the strengths of both traditional and innovative finance, the platform delivers top-notch security and attractive terms. Users can seamlessly lend or borrow using digital assets, earn interest, and connect effortlessly with any dApp, thanks to a user-friendly API.

- The platform is flexible, making it easier and faster to use than others on the market.

- The fintech startup could focus on core functionality while Euvic delivered the platform within 4 months at offshore rates.

- Thanks to the speedy product launch, the business was able to find more users and field test the platform.

.png)