Technical Due Diligence For Venture Capital Investors: The Ultimate Guide

The US is the largest tech market in the world, at $1.8 trillion in 2022. There are roughly 1000 active venture capital firms and 4500 private equity firms in the US, with many trying to capitalize on the tech economy.

Notably, VC firms receive more than 1,000 proposals for investments each year. Even businesses that aren’t classified as technology companies are made or broken by their technology infrastructure.

This makes understanding the technical foundation of a potential investment critical. Technology due diligence was once considered a simple matter of verifying a checklist of requirements, but today, all companies are technology companies.

Therefore, all due diligence must include a thoughtful assessment of technology. This involves not only examining the current state of technology but also understanding its scalability, security, compliance, and overall alignment with the company’s strategic goals.

As tech due diligence becomes a central element of an investment strategy, top investors view it as the first round in a continuous cycle of learning that extends throughout the ownership period and helps develop the most compelling exit story.

A thorough technical evaluation can reveal hidden risks and opportunities, providing a clear roadmap for future growth and development. This process includes assessing code quality, evaluating tech scalability, ensuring robust security measures, and verifying compliance with relevant regulations.

While looking at cap tables and financials will remain critical, the technical review of the due diligence process is more important than ever.

- Approximately 35% of Series A startups fail before they reach Series B.

- 20% of startups fail because they got outcompeted (CB Insights)

- Roughly 80% of tech and e-commerce startups will fail

- Up to 30% of VC-backed startups still fail despite extra funding

The stakes are high. Venture capital firms must access new skills and diligence processes to determine which startups and founders deserve capital.

Technology deals represent 31% of all buyouts—and a much higher percentage if you count deals where tech is central to value creation. Yet only a small percentage of buyers perform due diligence aimed at underwriting tech-specific risks and opportunities. The firms getting it right ensure that tech diligence is thesis-driven, integrated closely with commercial diligence, and tied directly to value creation.

It used to be that technology due diligence was a check-the-box exercise. Today, if an investor brings in a trusted CTO to conduct a standard diligence exercise that back-checks server infrastructure and enterprise resource planning, they will fail to assess risk and underwrite value truly.

This risk is especially high for investments that are not perceived as pure technology plays because investors underestimate the impact that tech infrastructure will play in their ability to grow the business and exit profitably.

In this article, we’ll review the tactics, systems, and strategies you need to have in place when conducting technical due diligence on your investments.

How To Conduct Technical Due Diligence For Investments

Today, tech due diligence requires understanding how technology is used throughout the end-to-end company to improve performance and mitigate risk. This comprehensive approach ensures that all aspects of the technology stack are evaluated, from the underlying infrastructure to the software applications and security protocols.

Our approach considers three critical questions:

- How does our client expect to create value at this target company?

- Is the right technology in place to enable this value?

- Will the cost of building new capabilities or expertise deliver on the required investment?

Here are a few considerations when underwriting the risk across key areas of a company.

1. Code Quality

- Analyze code performance: Identify non-optimal code segments, speed of database queries, duplicated code, unnecessary computations, etc.

- Assess code quality for compliance: Ensure adherence to best programming practices and regulatory compliance.

- Code readability and maintainability: Confirm if the code is readable, well-commented, uses consistent variable and function names, and applies appropriate design and architectural patterns.

- Automated testing: Evaluate the use of automated testing frameworks to ensure code reliability and reduce manual testing efforts.

2. Tech Scalability

- Architectural analysis: Analyze the overall structure of an application and compliance with architectural principles. Identify potential issues in the architecture.

- Dependency evaluation: Evaluate dependencies and libraries used in the code and document any known vulnerabilities.

- Scalability assessment: Determine if the technology stack can handle growth and increased load efficiently.

- Future-proofing: Assess the flexibility of the architecture to accommodate future technological advancements and business requirements.

3. Security

- Security review: Our security experts assess and investigate security including whether code is secure from attacks, and whether an application properly filters and escapes input data, uses prepared SQL statements or bound parameters, and enables appropriate security mechanisms.

- Vulnerability assessment: Conduct thorough security testing to identify potential vulnerabilities and provide recommendations for mitigation.

- Compliance with security standards: Ensure adherence to industry security standards and best practices.

- Incident response readiness: Evaluate the company’s preparedness for security incidents, including incident response plans and capabilities.

4. Compliance

- Regulatory compliance: Confirm whether the tech infrastructure complies with standards such as GDPR, HIPAA, and PCI-DSS.

- Data privacy and protection: Ensure that appropriate measures are in place to protect sensitive data and maintain user privacy.

- Compliance reporting: Provide detailed reports on compliance status and areas needing improvement.

- Ongoing monitoring: Recommend systems for continuous compliance monitoring to ensure ongoing adherence to regulations.

5. Infrastructure

- Resource utilization analysis: Analyze resource utilization to identify opportunities for cost reduction such as EC2 instance utilization, reviewing unnecessary resources, evaluating strategies for purchasing reserved instances or spot instances, etc.

- Performance optimization: Evaluate whether services are configured to achieve optimal performance.

- Disaster recovery and business continuity: Confirm if appropriate backup strategies and data recovery have been implemented. Validate that procedures are in place to ensure business continuity during a disaster.

- Automation: Confirm if processes are automated where possible, to increase efficiency and profitability.

- Scalability and flexibility: Assess the infrastructure’s ability to scale and adapt to changing business needs.

6. Observations and Suggestions

- Prioritized recommendations: Provide a prioritized list of additional observations and suggestions to link the company technology to the investor’s opportunity for value creation.

- Value creation strategies: Identify how technology can be leveraged to create maximum value and gain a competitive edge.

- Continuous improvement: Offer ongoing support and recommendations to ensure the technology evolves in alignment with business goals.

- Benchmarking: Compare the company’s technology with industry benchmarks to identify areas for improvement.

Common Challenges In Technical Due Diligence

Identifying and Mitigating Hidden Risks

One of the primary challenges in technical due diligence is uncovering less obvious technical risks that could impact the investment. These hidden risks can include outdated code practices, undocumented dependencies, and security vulnerabilities that are not immediately apparent.

Such risks, if left unaddressed, can lead to significant issues post-investment, including increased costs, operational disruptions, and regulatory penalties. Our team focuses on thorough investigations and deep dives into the technical stack to identify these latent issues early, providing strategies to mitigate them effectively.

Integrating Technical And Commercial Diligence

Aligning technical assessments with broader commercial objectives is another complex aspect of technical due diligence. It’s crucial to ensure that the technology infrastructure supports the company’s strategic goals and commercial viability.

This integration requires a holistic approach where technical insights are evaluated in conjunction with market opportunities, competitive positioning, and business scalability. Our experts work closely with commercial teams to create a unified diligence framework that aligns technology capabilities with business objectives, ensuring a cohesive strategy that maximizes value.

Dealing with Legacy Systems and Outdated Technology

Evaluating and modernizing older technology infrastructures present significant challenges during due diligence. Legacy systems often lack documentation, are built on obsolete technologies, and require substantial investment to upgrade. These systems can hinder innovation and scalability, posing a risk to the long-term success of the investment. Our approach includes assessing the viability of these legacy systems, determining the cost and impact of modernization, and providing actionable plans to transition to more current and scalable technologies.

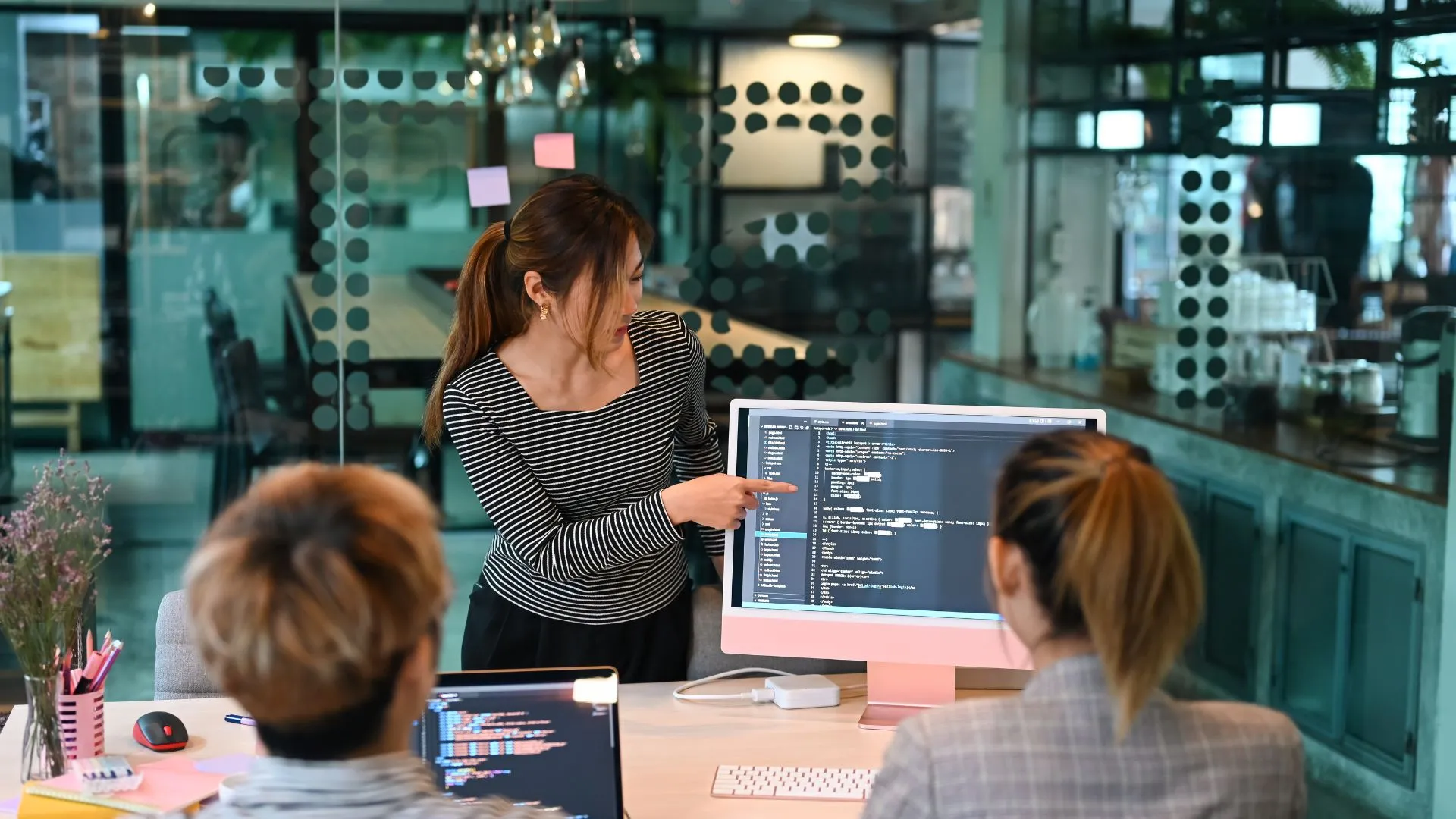

Best Practices for Effective Technical Due Diligence

The success of technical due diligence heavily depends on the expertise and experience of the team conducting the assessment. Having a knowledgeable and experienced team ensures a thorough and accurate evaluation of the technology stack. Our technical due diligence team comprises seasoned engineers and consultants with deep industry knowledge, enabling us to provide comprehensive insights and precise recommendations that are critical for informed investment decisions.

Maintaining a Continuous Learning Cycle Throughout the Ownership Period

Technical due diligence should not end with the initial investment. It’s essential to maintain a continuous learning cycle throughout the ownership period, conducting ongoing technical assessments and improvements. This approach helps in adapting to technological advancements, addressing emerging risks, and continuously enhancing the technology infrastructure. Our team supports investors with periodic reviews and updates, ensuring that the technology remains aligned with evolving business goals and industry standards.

Developing a Comprehensive and Actionable Due Diligence Report

A clear, detailed, and actionable due diligence report is vital for effective decision-making. Such reports should provide in-depth analyses, identify potential risks, and offer practical recommendations for improvements. Our due diligence reports are meticulously crafted to be comprehensive yet easy to understand, delivering valuable insights that guide strategic decisions and facilitate successful investments.

Prioritizing Transparency and Clear Communication with Stakeholders

Open communication channels are crucial to ensure all parties involved in the investment process are informed and aligned. Transparency in findings and clear communication of potential risks and opportunities build trust and foster collaborative decision-making. We prioritize transparent reporting and proactive communication with stakeholders, ensuring that everyone is on the same page and fully aware of the technical landscape and its implications for the investment.

The Role of Technology in Value Creation

A robust technology infrastructure is a cornerstone for driving business growth and enhancing profitability. Well-implemented technology solutions streamline operations, improve efficiency, and enable innovation, directly contributing to revenue growth and cost savings. Our technical due diligence services identify how technology can be leveraged to achieve these outcomes, providing a clear path to drive value creation through strategic technological investments.

Aligning technology with the company’s strategic objectives is critical for long-term success. A robust tech infrastructure supports operational agility, scalability, and market responsiveness, which are essential for achieving strategic goals. Our assessments ensure that the technology infrastructure is well-aligned with the business strategy, capable of supporting current needs, and adaptable to future growth and changes in the market landscape.

The Benefits Of Technical Due Diligence

Informed Investment Decisions

Our comprehensive technical due diligence enables investors to focus on qualifying their investments with confidence. Understanding the technology that comes with the deal ensures that all potential risks and opportunities are considered, leading to informed and strategic investment decisions.

Clear Roadmap for Growth

A thorough technical assessment provides a clear roadmap for future expenditures required to grow the company. This foresight helps in planning and allocating resources effectively, ensuring that the company can scale and adapt to market demands efficiently.

Optimized Results and ROI

By making stronger connections between the technology and value proposition, the company is empowered to optimize results and ROI. Our detailed reports and recommendations help in aligning technology investments with business objectives, driving maximum value and return on investment.

Enhanced Competitive Edge

Through detailed technical assessments, investors can identify unique opportunities to differentiate the business and outperform competitors. Understanding the technology landscape and leveraging it strategically provides a significant competitive advantage in the market.

Risk Mitigation

Comprehensive due diligence helps in identifying and mitigating potential risks early, safeguarding the investment. By addressing hidden risks and ensuring compliance with industry standards, investors can protect their investment and ensure long-term stability and growth.

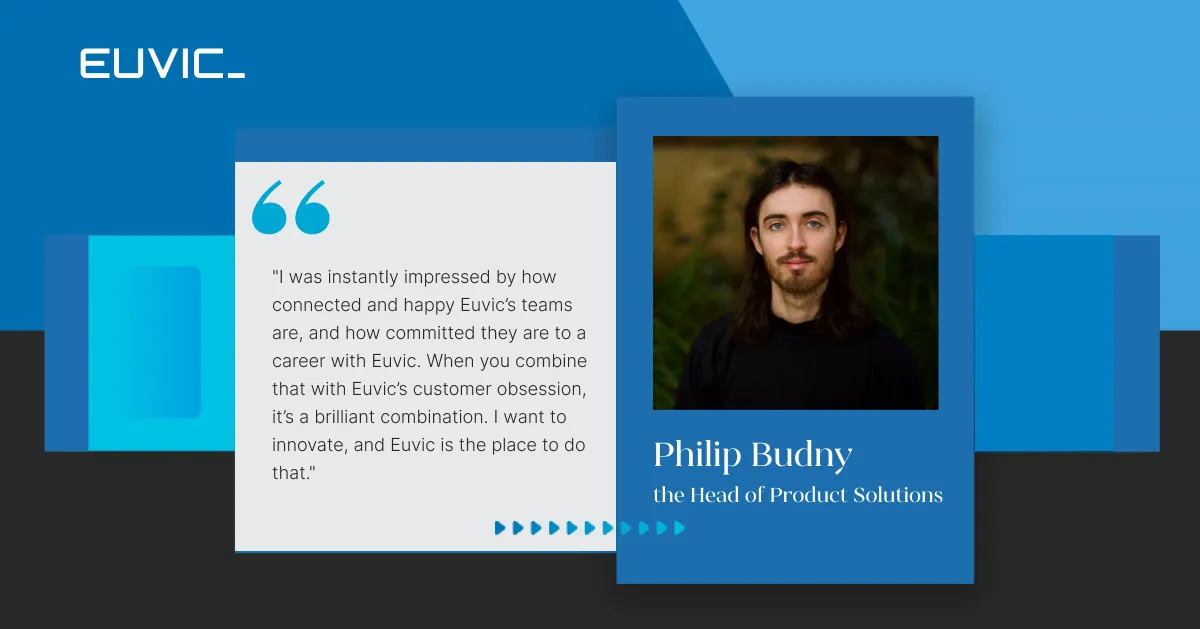

How Euvic Can Help: Experts in Technical Due Diligence

Euvic offers a wide range of technical due diligence services designed to meet the needs of potential investors. Our services include in-depth code quality analysis, scalability assessments, security evaluations, compliance checks, and infrastructure reviews. We also provide prioritized recommendations and strategic insights to help investors make informed decisions.

Our team comprises highly skilled engineers and consultants with extensive experience in the tech industry. We have a proven track record of successfully conducting technical due diligence for various investments, providing clear and actionable insights that drive value creation. Our expertise ensures that all aspects of the technology stack are thoroughly evaluated and aligned with business goals

Partnering with Euvic for technical due diligence enhances the investment process and outcomes. Our comprehensive assessments and detailed reports provide a clear understanding of the technology landscape, enabling investors to make informed decisions and mitigate risks effectively. With Euvic’s support, investors can confidently navigate the complexities of technical due diligence and maximize the value of their investments.

Euvic will conduct technical due diligence aimed at underwriting tech-specific risks and opportunities. With a tech due diligence report that links to commercial diligence, and tied directly to value-creation, VC and PE firms can make informed decisions that increase the odds of a profitable enterprise.

We invite you to reach out for a free no-obligation consultation to explore how Euvic can support your technical due diligence needs. Our experts are ready to provide personalized insights and recommendations to help you make informed investment decisions.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Talk to Your Local Euvic Team

.webp)