Top 10 Fintech Software Development Companies For Foward-Thinking Businesses

The demand for cutting-edge fintech solutions has never been greater.

In fact, according to Statista, the global fintech market is expected to exceed $300 billion by 2025. With this level of demand, businesses must find the right development partners to build secure and scalable products.

Choosing the best fintech software development company can be a critical decision for financial institutions and startups alike, one that impacts everything from compliance to user experience.

In this article, we’ll break down the top 10 fintech software development companies that have the necessary skills and experience to build world-class products.

Whether you’re a startup or an established financial institution, we’ll cover everything you need to know, from identifying the best companies in the fintech space to understanding how they can help solve your business challenges.

Why Work With a Fintech Software Development Company?

Fintech companies offer specialized solutions that address the distinct needs of the financial sector, from security to compliance.

- Compliance Expertise: These firms understand the intricacies of financial regulations like GDPR, PCI-DSS, and KYC, ensuring that your products align with legal requirements.

- Security-Centric Development: Fintech software developers are experts in building secure systems that protect against fraud, data breaches, and cyber-attacks.

- Blockchain Integration: Blockchain technology offers a secure, transparent, and immutable way to manage financial transactions, reducing operational risks.

- Scalability: These firms design platforms that can grow alongside your business, whether you’re handling increasing transaction volumes or expanding into new markets.

- Advanced AI Solutions: Companies specializing in fintech leverage artificial intelligence for fraud detection, predictive analytics, and personalized customer experiences.

What Makes a Great Fintech Software Development Company?

Choosing the right fintech software development company requires evaluating key traits that make a firm stand out in this specialized field.

- Strong Focus on Compliance: Top companies stay up-to-date with evolving regulations such as AML (Anti-Money Laundering) and CCPA (California Consumer Privacy Act) to ensure your product is fully compliant.

- Blockchain and Smart Contract Expertise: Leading firms integrate blockchain solutions and smart contracts to automate and secure financial transactions.

- Fintech-Specific Security Protocols: From encryption to multi-factor authentication, these companies prioritize security measures designed to protect sensitive financial data.

- Cloud-Native Development: Firms offering cloud-native solutions provide more flexibility, scalability, and enhanced security, essential for handling complex financial applications.

- Experience Across Multiple Sectors: Top fintech software development companies have a proven track record across various industries, including insurance, payments, and wealth management.

- AI and Machine Learning Integration: AI-powered fintech platforms enhance predictive modeling, automate customer service, and optimize fraud prevention efforts.

Popular Services for Fintech Software Development Companies

Fintech development firms provide a range of services that cater to the unique requirements of financial institutions. These services include advanced technological solutions to drive innovation and efficiency in the financial sector.

- Blockchain Development: Secure, decentralized applications that improve transparency and reduce the risk of fraud across financial operations.

- Payment Gateway Development: Seamless integration of payment gateways to facilitate quick, secure transactions between users and businesses.

- AI-Powered Analytics: Using AI for predictive analytics, risk assessment, and personalized financial services, helping businesses optimize decision-making processes.

- RegTech Solutions: Tools that assist businesses in adhering to complex regulations, including automated compliance and reporting systems.

- Mobile Banking Solutions: Development of user-friendly, secure mobile applications that offer seamless banking services on the go.

Now, let’s take a closer look at the top 10 fintech software development companies that are shaping the future of financial technology.

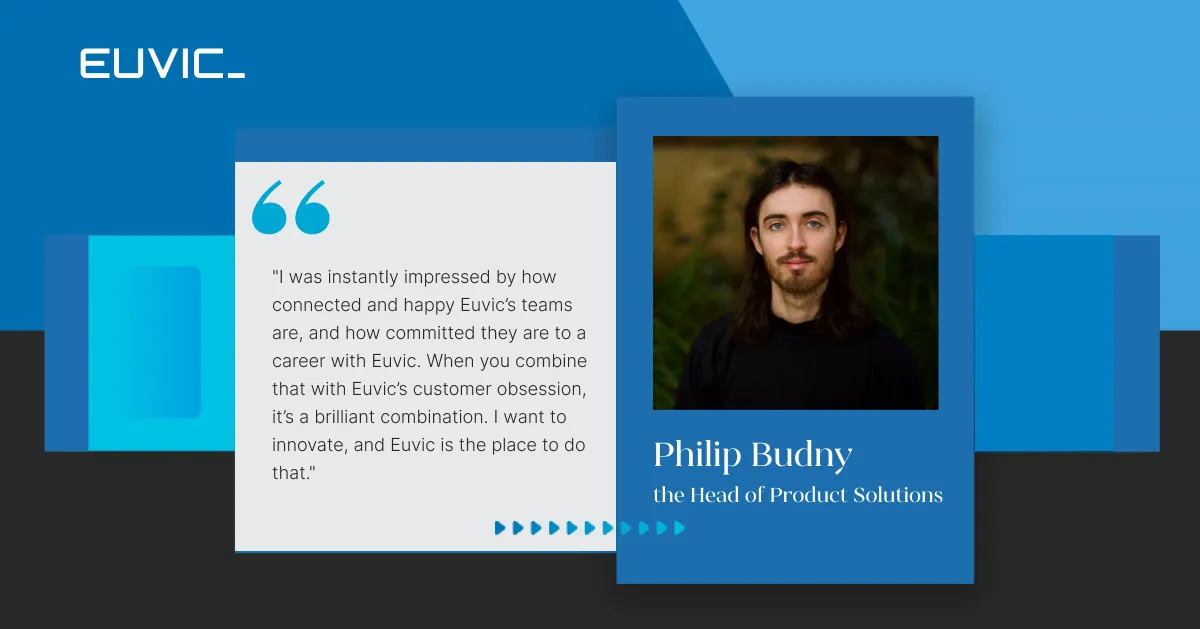

Euvic, Inc.: Leading Fintech Software Development Firm With High-Performing Global Talent

Overview: Who Are They?

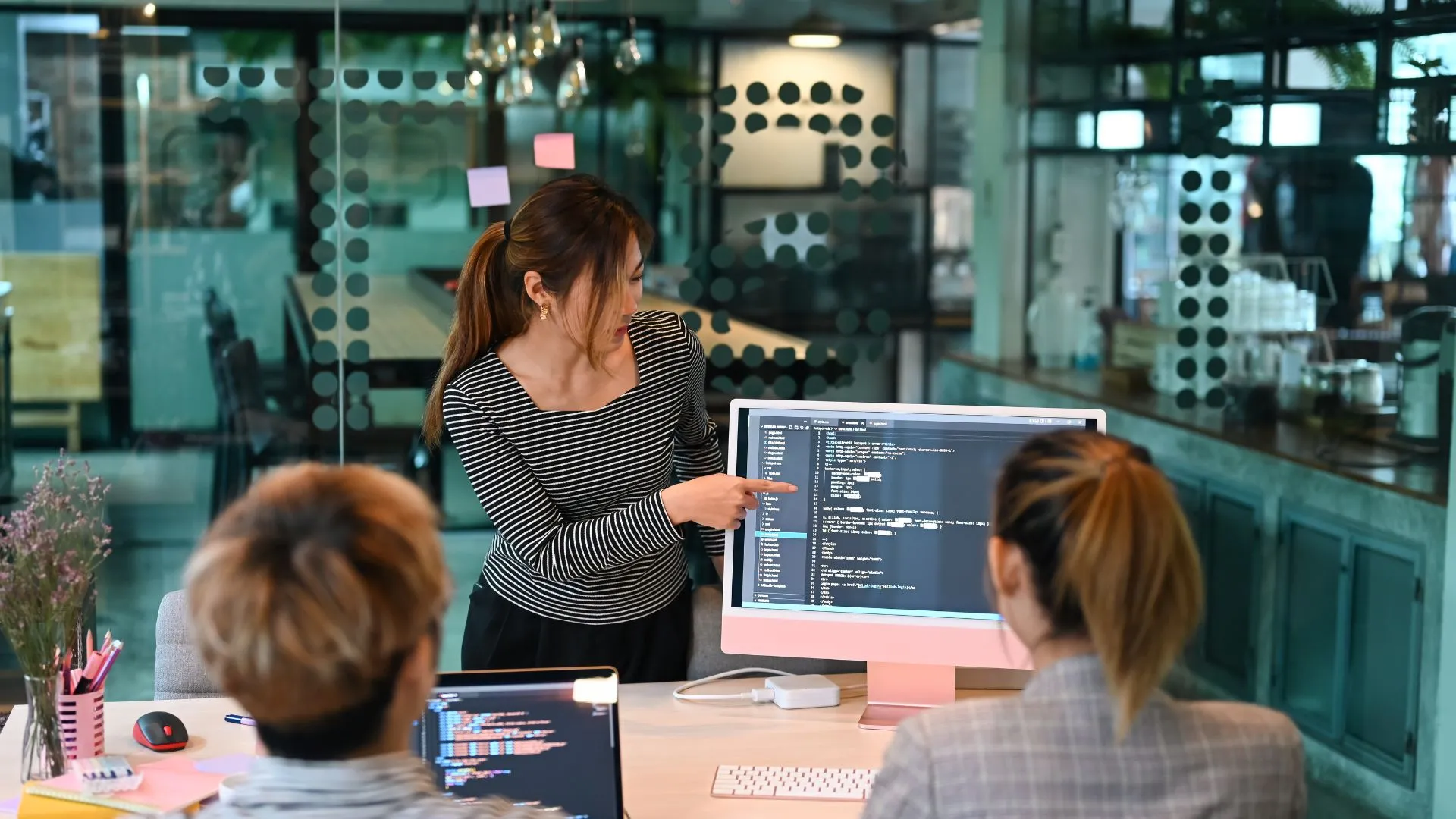

Euvic, Inc. is the US headquarters of a global technology company with over 6000+ engineers, primarily based in Poland. Specializing in fintech, Euvic bridges the gap between top-tier Polish engineering and US leadership, delivering scalable and secure financial technology solutions. With over 100 handpicked teams, they offer expertise across financial applications, AI, cloud infrastructure, and product design.

Services: What Do They Offer?

- Modernization/Digital Transformation: Euvic transitions fintech companies from legacy systems to cloud-native infrastructures, enhancing scalability, security, and regulatory compliance for high-volume transactions.

- Solution Architecture/Technical Consulting: Euvic designs resilient fintech architectures for blockchain, algorithmic trading, and fraud detection, offering audits and strategic API integrations for financial ecosystems.

- Integration Services: Euvic enables seamless fintech platform integration, connecting APIs for secure data exchange between payment processors, financial institutions, and verification services in real-time.

- Product Design and UX/UI Design: Euvic creates secure, user-friendly interfaces for fintech applications like mobile banking and DeFi platforms, balancing compliance with engaging user experiences.

- Mobile App Development: Euvic develops secure fintech mobile apps with features like multi-factor authentication, crypto wallets, and real-time trading for iOS and Android, ensuring data security and compliance.

- Front and Back-End Development: Euvic offers full-stack development for fintech platforms, focusing on secure data handling, advanced API integration, and real-time market analysis to support low-latency transactions.

- Cloud Development: Euvic delivers cloud-native fintech solutions, leveraging AWS, Azure, and Google Cloud for scalable infrastructures in high-frequency trading and AI-driven fraud detection systems.

- Artificial Intelligence & Machine Learning: Euvic applies AI/ML for predictive analytics, fraud detection, and automated underwriting, improving fintech platforms’ decision-making and operational efficiency.

- Software Quality Assurance (QA) and Testing: Euvic provides specialized QA services for fintech, including stress testing, automated regression testing, and security checks for high-frequency trading and transaction systems.

- DevOps: Euvic optimizes fintech software development through CI/CD pipelines, infrastructure as code, and continuous monitoring, accelerating deployment while ensuring reliability for critical financial systems.

- Infrastructure and Maintenance: Euvic offers 24/7 IT infrastructure management for fintech, with services including cloud monitoring, network security, and support for transaction-heavy, high-availability environments.

- Staff/Team Augmentation: Euvic provides fintech firms with specialized talent in blockchain, cloud architecture, and AI, offering managed teams for seamless scalability in development and system maintenance.

About: What Sets Them Apart?

- Global Engineering Talent: Euvic offers access to 6000+ engineers ranked in the top 5 globally, delivering fintech solutions across blockchain, AI, and advanced financial system integrations.

- Cost-Efficient Scalability: Euvic enables fintech companies to scale quickly by expanding development efforts without added overhead, allowing for cost control during digital transformation projects.

- Compliance-Driven Development: Euvic specializes in building fintech solutions that meet global regulations, including GDPR, PSD2, and PCI DSS, providing secure, compliant financial products.

- Proven Track Record: Euvic has delivered over 1000 fintech projects, handling complex areas such as high-volume transactions, fraud detection systems, and custom financial app development.

- Seamless Integration: Euvic’s expertise in fintech platform integration ensures efficient, secure connections across payment systems, financial institutions, and third-party verification services.

Client Profile: Who Do They Work With?

Euvic partners with fintech firms, banks, and financial institutions looking to transform their digital capabilities. Their clients include companies requiring advanced cloud infrastructure, blockchain integration, AI-driven financial analytics, and scalable mobile banking solutions. Whether it’s building a new crypto wallet, upgrading an existing trading platform, or automating loan processing, Euvic’s expertise serves fintech enterprises across the globe.

Itexus: Expert Fintech Software Development Specialists With End-to-End Software Capabilities

Overview: Who Are They?

Itexus is a full-cycle fintech software development company that builds custom financial solutions for startups and established enterprises. Since 2013, the company has completed over 300 projects in 23 countries, focusing on cutting-edge financial products such as AI-powered trading platforms, digital banking systems, and mobile payment solutions.

Services: What Do They Offer?

- Custom Finance Software Development: Itexus delivers end-to-end financial software solutions, including mobile apps, enterprise-grade platforms, and AI-powered systems tailored for financial services.

- Fintech and Digital Transformation Consulting: Itexus advises fintech companies on leveraging emerging technologies, enhancing operational efficiency, and scaling fintech solutions through digital transformation.

- Financial Mobile App Development: Specialized in developing mobile finance apps, Itexus creates secure, user-friendly applications for banking, lending, payments, and investment management.

- Financial Product Development: Itexus builds custom financial products such as algorithmic trading platforms, credit scoring systems, and portfolio management tools designed for fintech scalability and security.

- Fintech UI/UX Design and Prototyping: Creating intuitive and compliant user interfaces, Itexus optimizes the design of fintech platforms to drive user engagement while meeting regulatory standards.

About: What Sets Them Apart?

- Fintech Specialization: Itexus focuses solely on fintech, offering deep domain expertise in developing regulatory-compliant financial software solutions across various financial verticals.

- AI and Blockchain Expertise: Itexus incorporates AI and blockchain technologies in fintech solutions, enabling automation of processes such as fraud detection, predictive analytics, and decentralized finance.

- Proven Track Record: With over 300 successful fintech projects globally, Itexus has demonstrated its ability to deliver complex solutions that meet financial industry standards.

- Compliance-Driven Development: Itexus ensures all software meets the latest financial regulations, including AML/KYC, PSD2, and GDPR, reducing legal risk for fintech clients.

- End-to-End Service Provider: Itexus offers full-cycle fintech software development services, from consulting and design to implementation, cloud deployment, and ongoing maintenance.

Client Profile: Who Do They Work With?

Itexus works with fintech startups, banks, investment firms, and financial institutions, developing custom solutions that automate financial processes, enhance operational efficiency, and ensure regulatory compliance. Their clients range from early-stage fintech ventures to established global financial organizations looking to innovate through technology.

Eureka Software Solutions: A Leader In Full-Stack Software And Legal Expertise For Financial Solutions

Overview: Who Are They?

Eureka Software Solutions, headquartered in Austin, TX, has been delivering custom software development and expert witness services for over 40 years. Specializing in fintech, Eureka partners with clients in finance, e-commerce, and healthcare, offering tailored software solutions and expert testimony in IP litigation, trade secrets, and contract performance cases.

Services: What Do They Offer?

- Custom Software Development: Eureka crafts scalable, high-performance fintech software for financial institutions, ensuring secure processing, transaction automation, and compliance with industry standards.

- Expert Witness Services: With decades of industry expertise, Eureka provides critical testimony in software litigation, focusing on trade secrets, source code, contract disputes, and patent infringement.

- Database Development: Eureka builds robust and high-performing databases that manage financial data efficiently, optimizing information retrieval, and improving overall system functionality.

- DevOps & CI/CD Services: Streamlining software development through continuous integration and automated deployment, Eureka enhances the delivery pipeline, improving software performance and reducing release cycles.

- UI/UX Design: Delivering intuitive, user-friendly interfaces for fintech applications, Eureka integrates functionality with compliance-driven design to create seamless user experiences.

About: What Sets Them Apart?

- Expert Witness Leadership: With over 500 hours of expert testimony, Eureka brings unparalleled legal insights into complex software litigation for fintech and technology firms.

- Legacy in Software Development: With four decades of experience, Eureka has a long-standing reputation for delivering innovative fintech solutions that evolve with the market.

- Scalable Fintech Solutions: Eureka’s deep expertise in creating secure, scalable fintech platforms positions them as a leader in financial technology development for enterprises and startups alike.

- Specialized Forensics Capabilities: Eureka’s team offers advanced software forensics and data recovery services to protect intellectual property and recover crucial financial data.

- Client-Centric Approach: Eureka’s dedicated project management and agile methodology ensure that every solution is delivered with precision, meeting the unique needs of each financial institution.

Client Profile: Who Do They Work With?

Eureka partners with financial institutions, fintech startups, and enterprises seeking cutting-edge software solutions for transaction processing, risk management, and digital banking. Their clients range from investment firms and banks to healthcare organizations and e-commerce platforms, providing tailored development, consulting, and litigation services to enhance operational efficiency, improve data security, and deliver impactful business results.

Learn More About Eureka Software Solutions Here

Uran Company: Cross-Platform Apps And Blockchain Development For Innovative Businesses

Overview: Who Are They?

Uran Company, an international software development firm, has been transforming businesses through bespoke digital solutions for over 17 years. With expertise in web, mobile, and blockchain technologies, they cater to SMBs, startups, and enterprises across various industries, offering end-to-end development services and extensive QA.

Services: What Do They Offer?

- Custom Application Development: Leveraging a wide array of modern technologies, Uran delivers fully customized web and mobile applications that meet specific business needs while maintaining scalability and security.

- Cross-Platform App Development: Uran specializes in developing hybrid mobile applications, enabling seamless experiences across multiple platforms, ensuring business agility without compromising performance.

- Web3 and Blockchain Development: Uran builds decentralized applications, leveraging blockchain technologies to deliver secure, transparent, and innovative solutions that cater to modern business models.

- AWS Consulting and Solutions: Uran offers cloud-based solutions with a focus on scalability, security, and cost-efficiency by utilizing AWS services to optimize infrastructure and application performance.

- Software Integration Services: Uran integrates third-party services and legacy systems, creating cohesive solutions that streamline workflows, enhance productivity, and reduce operational silos.

About: What Sets Them Apart?

- 17 Years of Expertise: Uran’s extensive experience in delivering high-quality, customized software solutions sets them apart in an ever-competitive market.

- Comprehensive Tech Stack: Equipped with advanced tools and frameworks, Uran ensures the development of resilient, high-performance applications across web, mobile, and blockchain platforms.

- Flexible Engagement Models: Uran offers a variety of cooperation models, including full project development or team augmentation, allowing businesses to scale with ease.

- Focus on Security: With a strong commitment to data protection, Uran implements rigorous security measures, ensuring encryption and secure transmission for all applications and services.

- Dedicated QA Department: Uran’s internal QA team conducts thorough testing across all development phases, guaranteeing high-quality deliverables that meet industry standards.

Client Profile: Who Do They Work With?

Uran partners with startups, SMBs, and established enterprises across industries such as e-commerce, fintech, healthcare, and education. Their clients range from digital agencies looking to outsource development projects to large businesses seeking full-scale digital transformation. Uran’s ability to deliver tailored software solutions has helped numerous businesses achieve operational efficiency and market growth.

Learn More About Uran Company Here

Saritasa: Advanced Fintech Software Development Backed By Proven Security And Compliance Experience

Overview: Who Are They?

Saritasa is a leading custom software development company specializing in comprehensive solutions for financial institutions and fintech startups. With 18 years of experience, Saritasa delivers scalable software that adheres to the most stringent security and compliance protocols while optimizing workflows and enhancing automation across various platforms.

Services: What Do They Offer?

- Custom Fintech Software Development: Saritasa builds bespoke financial solutions, integrating advanced compliance, security, and analytics to meet the specific demands of modern financial services.

- Data Analytics Systems: By developing deep analytics platforms, Saritasa enables clients to process complex financial data in real time, generating actionable insights for better decision-making.

- Mobile Banking and Trading Platforms: Saritasa designs intuitive mobile applications for secure banking and trading, enhancing the user experience while maintaining seamless functionality across devices.

- Legacy System Modernization: Saritasa revitalizes outdated financial systems with cutting-edge technologies, allowing for enhanced performance, better scalability, and easier integration with new services.

- Virtual and Augmented Reality: Saritasa introduces immersive VR and AR experiences for financial institutions, offering engaging tools for client education, employee training, and interactive trade show demonstrations.

About: What Sets Them Apart?

- Focus on Financial Compliance: Saritasa’s deep understanding of industry regulations allows them to deliver compliant software solutions that safeguard both data integrity and user privacy.

- Proven Expertise Across Platforms: Saritasa excels in cross-platform development, ensuring applications function seamlessly across mobile, web, and desktop environments, reducing operational friction.

- Strategic Problem-Solving: Saritasa’s team takes a solution-driven approach, applying technical acumen to create systems that address complex financial challenges and streamline operational workflows.

- End-to-End Project Management: From concept to deployment, Saritasa offers full lifecycle project management, handling all phases from product ideation through iterative development and final release.

- DevOps and Continuous Integration: Saritasa employs cutting-edge DevOps practices, enabling faster deployment, automated testing, and continuous delivery for evolving financial products.

Client Profile: Who Do They Work With?

Saritasa collaborates with a diverse range of clients, including fintech startups, established financial institutions, and marketplaces requiring secure backend solutions. Their clients include businesses that need advanced analytics, compliance-focused software, and automated processes for payment systems, mobile trading, and virtual wallets. By providing highly tailored solutions, Saritasa helps clients stay competitive in an increasingly digital financial landscape.

Learn More About Saritasa Here

Geniusee: Custom Solutions For Fintech Companies With Predictive Analytics And Secure Platforms

Overview: Who Are They?

Geniusee is a leading software development company with a deep focus on building transformative fintech platforms. Their expertise spans from e-wallets to core banking systems, delivering scalable solutions that meet the evolving demands of financial services. Through partnerships with AWS and leading open banking providers, Geniusee empowers fintech businesses with cutting-edge technology.

Services: What Do They Offer?

- Blockchain-Based Financial Solutions: Secure and decentralized platforms for payments, transactions, and asset management.

- e-Wallet Development: End-to-end development of digital wallets, enabling seamless, secure transactions for users.

- Predictive Analytics Platforms: Data-driven systems that enable financial institutions to forecast market trends and optimize decision-making.

- Lending and Trading Software: Scalable, compliant lending and trading platforms, designed to support financial operations efficiently.

- AI-Driven Fraud Detection: Advanced machine learning models to detect anomalies and prevent financial fraud in real time.

About: What Sets Them Apart?

- Proven Expertise in Financial Security: Geniusee integrates robust encryption protocols and compliance measures to safeguard financial data.

- Partnerships with Leading Providers: Collaborations with Plaid and Finicity to enhance fintech services with seamless open banking integrations.

- Focus on Regulatory Compliance: Specialized in adhering to industry-specific regulations such as PSD2 and GDPR for fintech software.

- Scalability through Cloud-Native Architecture: Leveraging AWS infrastructure to ensure high performance and scalability for financial platforms.

- Customizable Solutions for Fintech Growth: Tailored fintech solutions that scale with your business and meet the dynamic needs of the financial sector.

Client Profile: Who Do They Work With?

Geniusee partners with a wide array of clients, from fintech startups to established financial institutions. Their solutions cater to businesses looking for custom financial software, such as e-wallets, digital banking systems, blockchain-based applications, and fraud detection platforms. Clients benefit from their ability to develop scalable, secure, and compliant fintech solutions tailored to the ever-evolving needs of the financial services industry.

Learn More About Geniusee Here

WEZOM: Future-Proof Fintech Software Development Solutions

Overview: Who Are They?

WEZOM is a tech solutions provider with over 20 years of experience, delivering fintech software tailored to optimize transaction management, streamline operations, and meet compliance requirements. With 3,500+ projects completed, WEZOM builds fintech infrastructures that drive efficiency and growth.

Services: What Do They Offer?

- Fintech Platforms: Bespoke platforms built for handling high-volume transactions, enabling automated processing, data analytics, and real-time risk management.

- Digital Banking Tools: Comprehensive systems for digital banking, integrating fraud detection, real-time account access, and secure API-driven financial operations.

- Wealth Management Automation: Solutions powered by AI and machine learning, offering personalized investment tools, portfolio monitoring, and intelligent advisory systems.

- Blockchain Solutions: Advanced blockchain integration for secure, transparent financial transactions, tokenization, and compliance within decentralized ecosystems.

- Regulatory Technology (RegTech): Systems designed to automate regulatory tasks, real-time monitoring, and compliance management across multiple financial jurisdictions.

About: What Sets Them Apart?

- Integration Capabilities: Solutions connect smoothly with existing fintech infrastructures, making implementation efficient without major disruptions.

- Security Focus: Platforms feature multi-layered security, including biometric verification and AI-driven fraud protection, aligning with the highest compliance standards.

- High-Volume Transaction Processing: Architecture is optimized to support large-scale operations, reducing latency in fintech environments that demand seamless performance.

- Compliance-Driven Development: Deep expertise in regulatory frameworks, offering automated solutions that adapt to financial regulations across various regions.

- AI-Driven Analytics: Cutting-edge AI models power predictive insights for credit scoring, risk assessment, and algorithmic trading, delivering actionable data for fintech firms.

Client Profile: Who Do They Work With?

WEZOM works with a broad range of enterprises, from mid-size businesses to large-scale corporations across various industries. Their key clients include leaders in logistics, manufacturing, healthcare, financial services, and eCommerce. Some notable partnerships include global brands such as Toyota Material Handling, Cooper&Hunter, and Aptiv PLC. WEZOM is trusted for their ability to deliver custom, scalable solutions that meet the unique demands of each client’s digital transformation goals.

Curotec: Fintech Software Development Solutions Leveraging Agile Expertise

Overview: Who Are They?

Curotec offers high-caliber software development services specializing in fintech platforms. With a focus on secure, scalable, and data-driven financial technologies, Curotec builds solutions that streamline operations, automate workflows, and provide seamless digital experiences.

Services: What Do They Offer?

- Fintech Product Development: Custom-built platforms for financial transactions, asset management, and payment processing, optimized for scalability and compliance.

- API Integrations: Secure and reliable API development for seamless data exchange between financial platforms, enhancing operational efficiency across fintech ecosystems.

- AI-Powered Analytics: Advanced AI tools for predictive financial modeling, real-time fraud detection, and personalized customer experiences in fintech environments.

- RegTech Systems: Comprehensive solutions for automating compliance, from reporting to auditing, minimizing manual oversight in high-risk financial sectors.

- Digital Transformation: End-to-end digital overhaul for legacy systems in financial services, enabling modern functionalities like blockchain integration and mobile banking capabilities.

About: What Sets Them Apart?

- Advanced Security Protocols: Rigorous development standards that prioritize multi-layer encryption and zero-trust architectures in fintech applications.

- Custom Solutions: Expertise in delivering highly customized, compliant fintech systems built to address the specific challenges of digital banking, lending, and wealth management.

- Global Reach: A strong team distributed across the U.S. and LATAM, offering specialized talent to fintech companies seeking advanced technical solutions.

- Scalable Infrastructure: Focus on building fintech platforms that easily scale to support millions of transactions while maintaining low latency and optimal performance.

- AI-Driven Innovations: Deep integration of AI technologies that drive real-time decision-making, algorithmic trading, and customer personalization in the fintech space.

Client Profile: Who Do They Work With?

Curotec partners with fintech startups, established financial institutions, and SaaS providers looking to modernize and scale their digital infrastructures. Their clients seek secure, compliant, and high-performing solutions to handle complex financial workflows, enhance user engagement, and maintain an edge in competitive fintech markets.

Kindgeek: A New Kind Of Fintech Software Development Firm With White-Label Solutions

Overview: Who Are They?

Kindgeek provides full-cycle fintech software development, helping businesses create core banking, payment platforms, and neobanks. Their white-label solutions empower startups and enterprises to bring products to market efficiently, backed by pre-built features that reduce development time and costs.

Services: What Do They Offer?

- White-Label Neobanks: Launch digital banking products with pre-configured features, minimizing time-to-market without sacrificing scalability.

- eWallet Development: Create secure, feature-rich wallets tailored for digital transactions, including P2P transfers and multi-currency support.

- RegTech Solutions: Build compliance systems covering KYC, AML, and financial reporting, enabling automated governance across platforms.

- Core Banking Systems: Implement scalable infrastructures for digital banking with support for multi-currency accounts, real-time transactions, and API integrations.

- AI-Powered Analytics: Integrate machine learning models to enhance financial forecasting, detect anomalies, and drive intelligent decision-making.

About: What Sets Them Apart?

- Pre-Built Fintech Features: A feature-rich toolkit, including multi-currency wallets and customizable account systems, that accelerates product deployment.

- Compliance-First Approach: Expertise in crafting systems compliant with global financial regulations, covering KYC, AML, and data privacy protocols.

- Seamless API Integration: Over 400 RESTful APIs designed for easy integration with payment processors, banking institutions, and third-party platforms.

- Modular Scalability: A flexible infrastructure allowing fintech platforms to scale seamlessly as business demands grow, without compromising on performance.

- AI and DeFi Integration: Advanced solutions integrating AI and decentralized finance (DeFi), driving innovation in financial management, security, and automation.

Client Profile: Who Do They Work With?

Kindgeek collaborates with fintech startups, established financial institutions, and SaaS providers looking to develop secure, scalable solutions. Their clients seek to create cutting-edge financial products like neobanks, e-wallets, and regulatory platforms that meet market demands while optimizing operational efficiency.

Learn More About Kindgeek Here

Hexaview: Driving Fintech Software Development With Secure Solutions

Overview: Who Are They?

Hexaview delivers fintech software solutions across the financial sector, leveraging AI, ML, and blockchain to empower banks, financial institutions, and wealth managers. Their services span from capital markets and lending platforms to wealth management, providing clients with efficient, secure, and scalable systems.

Services: What Do They Offer?

- Wealth Management Solutions: Empower financial advisors with tools for goal-based planning, investment insights, and data-driven analytics to enhance client engagement.

- Capital Markets Software: Provide firms with efficient trading systems, real-time trade lifecycle tracking, and compliance solutions across asset classes.

- Lending Platforms: Automate loan origination, P2P lending, and loan management with data-driven tools and customizable workflows.

- Salesforce Consulting: Offer end-to-end Salesforce implementations, customization, and data migration to improve business performance.

- Cloud Services: Deliver secure cloud-based infrastructure for fintech applications, enhancing flexibility, data access, and cost efficiency.

About: What Sets Them Apart?

- End-to-End Fintech Solutions: A comprehensive approach, delivering services from development to deployment for fintech applications like digital wallets and payment gateways.

- Data-Driven Insights: AI and ML integration for wealth management, lending, and capital markets, providing clients with actionable analytics and predictive models.

- Compliance Expertise: Deep knowledge in regulatory frameworks such as KYC and AML ensures fintech solutions adhere to global standards.

- Customizable Fintech Platforms: Modular architecture allows for tailored fintech products, from blockchain integration to secure digital banking systems.

- Operational Efficiency: Automation across processes like lending and trading to optimize workflows and minimize manual intervention.

Client Profile: Who Do They Work With?

Hexaview collaborates with banks, wealth management firms, and fintech startups seeking secure, scalable, and compliant financial software. Their clients include financial institutions looking to modernize operations, optimize risk management, and enhance customer engagement through advanced technology solutions.

Learn More About Hexaview Here

How To Start Working With A Fintech Software Development Company

Step 1: Define Project Objectives

Clarify the specific outcomes you want from your fintech project. Identify areas for improvement, such as payment processing, blockchain integration, or data analysis through AI. Clear goals will direct the development process to focus on key business areas.

Step 2: Review Current Infrastructure

Examine the technology stack you have in place. This helps identify gaps and opportunities for upgrades or new integrations. A thorough review allows the development company to suggest solutions that complement your current systems.

Step 3: Research Development Partners

Select a fintech software development firm with a proven record in your sector. Look for companies with experience in regulatory compliance, security, and scalability. A specialized partner can offer the right expertise to meet your project’s requirements.

Step 4: Check for Technological Expertise

Confirm the development partner has experience with technologies like AI, blockchain, and cloud computing. These technologies are vital for creating secure and scalable financial systems. Review case studies and past work to gauge their proficiency.

Step 5: Establish Clear Communication

Set up efficient communication channels with the development team. Consistent updates, agile methods, and a structured approach to project management help keep everything aligned with your goals.

Step 6: Prioritize Security and Compliance

Discuss the firm’s approach to security protocols such as encryption and multi-factor authentication. This is particularly important for projects involving financial transactions or sensitive data. A strong focus on regulatory standards helps mitigate risks.

Step 7: Plan for Growth

Design systems that can expand as your business grows. Work with the development team to create platforms that can handle more transactions, integrate with third-party services, and adapt to future industry shifts. Scalability is key to long-term success.

Partner With Best-In-Class Fintech Software Developers At Euvic

Euvic stands out as a leading choice for fintech software development, offering a wide range of services that address the specific needs of financial institutions and businesses. With their extensive expertise in cloud solutions, AI integration, blockchain, and regulatory compliance,

Euvic consistently delivers high-quality results. Their approach to project management, coupled with access to top-tier engineering talent, ensures seamless execution from concept to completion.

For businesses seeking a trusted development partner that can deliver scalable, secure, and innovative solutions, Euvic provides the expertise needed to meet and exceed project goals.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Talk to Your Local Euvic Team

.webp)