FinTech: The Digital Evolution of Finance

FinTech, the powerful blend of finance and technology, has reshaped the financial landscape over the past decade, leading advancements in digital payments, e-commerce, and mobile point-of-sale systems. What sets FinTech apart is its capability to enhance digital revenue streams, facilitate data-driven decisions, and streamline processes, all fueled by consumer demands for efficient, user-friendly financial tools.

China stands out as the global leader in FinTech, with digital payment transactions worth $2496 billion in 2020. Meanwhile, the U.S. ranks second, housing over 10,605 FinTech startups as of February 2021, predominantly in the personal finance sector.

In Poland, 2019 marked significant growth for FinTech. That year, third-party entities were allowed access to bank customer data and could process payments without exclusive bank agreements. This innovation momentum has cast Poland as a pivotal player in the FinTech sphere, attracting substantial foreign investment. As of 2020, Poland’s FinTech sectors include:

- Payments: 23.4%

- Corporate Finance Management: 11.3%

- Personal Finance Management: 9.5%

- Internet Currency Exchange: 7.7%

- Loan Institutions: 7.2%

- Loans and Mortgages: 7.2%

- Blockchain and Cryptocurrencies: 4.5%

- Factoring: 4.5%

- Software Providers: 4.5%

Implementing a FinTech strategy is not without challenges, such as regulatory hurdles, outdated systems, non-compatible data structures, a lack of FinTech understanding, and resistance to innovation.

However, successful FinTech adoption revolves around three main pillars:

Ensuring cybersecurity, transparency, and tailoring solutions to customer needs.

Incorporating new technologies holistically, fostering digital skills, and prioritizing employee well-being.

Collaborative models and strategic planning using MVP (Minimum Viable Product) frameworks.

The future of finance is marked by technologies like Blockchain, Cloud, Big Data, and Artificial Intelligence:

Improves transaction efficiency, transparency, and cost-effectiveness.

Enhances banking operations by optimizing data management and reducing costs.

Provides insights into customer behaviors, enabling superior FinTech services.

Automates processes, enhancing time efficiency, cost savings, and customer experience.

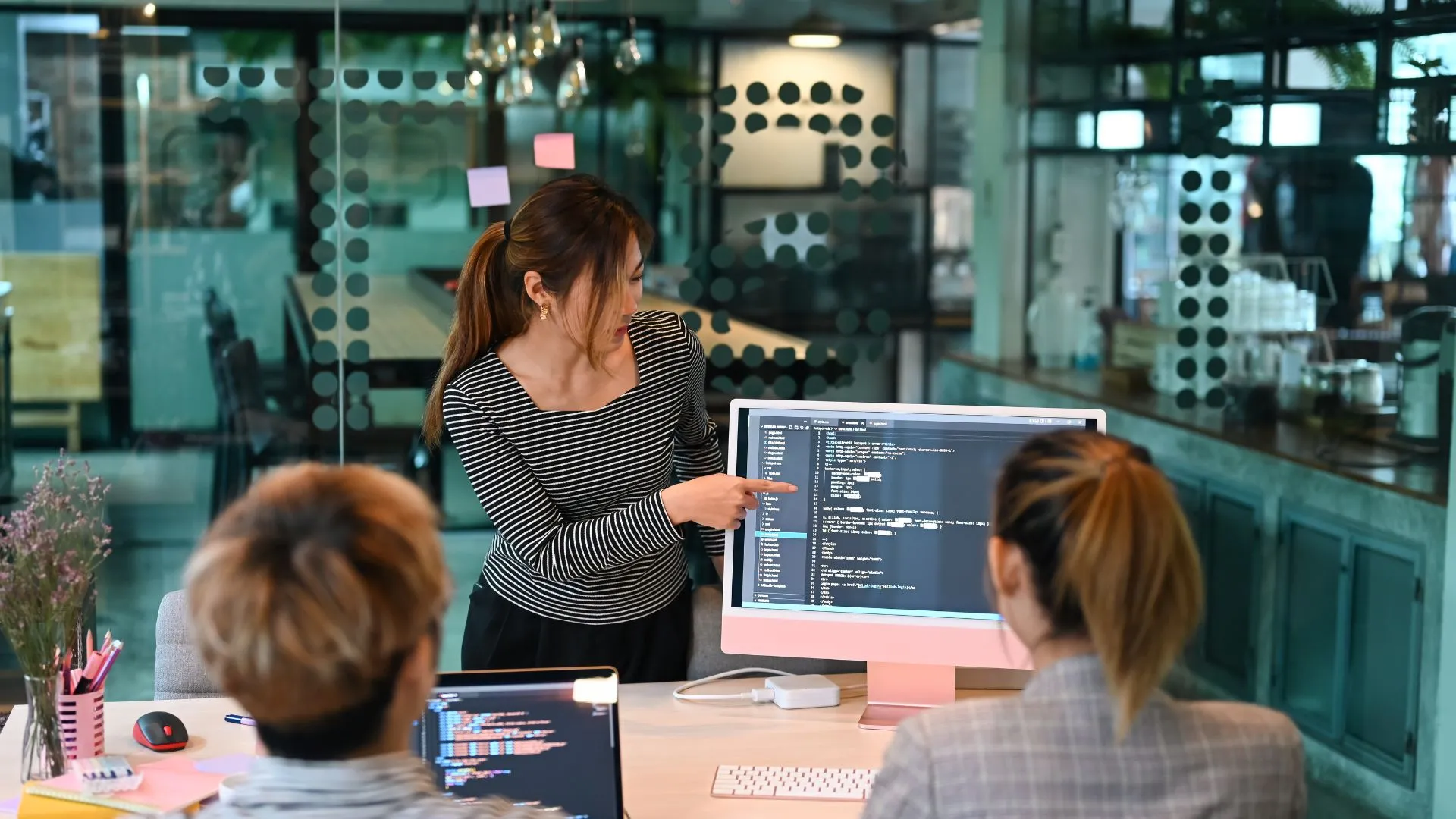

With our “MVP as a Service” model, we expedite the validation of FinTech business concepts, leveraging technologies like AI, ML, Big Data, Blockchain, RPA, VR, and more. We specialize in:

- Cryptocurrency exchanges

- AI-powered chatbot virtual assistants

- Virtual wallets

- Mobile banking apps

- Financial service platforms

- Complex investment product management platforms

Bringing FinTech solutions to life requires expertise and experience. As a seasoned technology partner, we shoulder the responsibility of innovative tech adoption, guiding our clients from ideation to implementation.

Contact us to explore the possibilities.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Talk to Your Local Euvic Team

.webp)