Top 5 Banking & Fintech UX Design Case Studies To Spark Inspiration

Ever noticed how the sleekness of a banking app can make or break your experience?

In the world of fintech, design isn’t just about looking good; it’s about functionality, trust, and keeping users engaged. With digital wallets replacing bulky billfolds and transactions happening at the tap of a screen, the design behind these experiences is crucial.

So, what sets apart the fintech apps you can’t stop raving about from the ones you delete after one use?

In this post, we’re showcasing our top 5 banking & fintech design case study examples from one of our Centers of Excellence (CoE), Artkai, which excels in user experience design.

From intuitive user interfaces to innovative security features, these designs aren’t just pretty—they’re effective. Ready to see what makes a fintech design truly exceptional?

Let’s dive in.

Why Work With Banking & Fintech Software Development Companies?

Navigating the complexities of fintech requires more than just tech know-how. Specialized companies bring expertise tailored to the financial sector, ensuring every solution is secure, user-friendly, and built to last.

- Specialized Knowledge: These companies understand the unique regulations and requirements of the financial industry, which means fewer headaches and faster compliance.

- Focused Innovation: Their deep industry focus ensures that your fintech solution isn’t just functional—it’s at the forefront of innovation, meeting the latest user expectations.

- Security Expertise: With financial data at stake, these experts know how to build solutions that protect user information, keeping your brand trusted and credible.

- Regulatory Compliance: Specialized fintech and banking development firms adhere to complex regulatory compliance standards. They also can help you stay ahead of evolving regulations, minimize risks, and protect your institution from potential legal and financial repercussions.

- Scalability: As your financial institution grows, so too can the solutions these companies provide, ensuring you’re always ready to meet increasing demand.

- Efficiency: Time is money, and these companies streamline development processes to get your fintech app to market faster, giving you a competitive edge.

What Makes Great Banking & Fintech Design?

When it comes to fintech, a great design goes beyond aesthetics—it’s about delivering a seamless experience that builds trust and encourages user engagement.

- Intuitive Navigation: Users should be able to perform complex transactions with ease, thanks to clear, straightforward pathways that minimize friction.

- Engaging Interfaces: Visual appeal matters, but in fintech, it’s also about creating an interface that invites users to engage and explore features effortlessly.

- Responsive Design: Whether on a smartphone, tablet, or desktop, the design should adapt flawlessly, ensuring a consistent experience across all devices.

- Accessibility: Inclusive design is key. A great fintech product is one that everyone can use, regardless of ability, ensuring broad appeal and usability.

- Alignment with User Personas: By aligning design elements with the specific needs, behaviors, and goals of each user type, great design should offer a seamless experience that feels intuitive and personal.

- Data Visualization: Transforming complex financial data into easy-to-understand visuals helps users make informed decisions quickly, enhancing the value of your service.

Popular Features For Banking & Fintech Design

In today’s fast-paced digital environment, fintech apps need to offer features that are not just useful but essential for maintaining user engagement and trust.

- AI-Powered Chatbots: These virtual assistants provide users with instant support, handling inquiries and tasks around the clock, making the experience more personal and efficient.

- Precise Personalization: Offering customized user experiences that cater to individual preferences, enhancing user engagement and fostering brand loyalty by making each interaction feel uniquely suited to the user’s needs.

- Gamification Elements: By incorporating game-like features such as rewards and challenges, fintech apps can make financial management more engaging and even fun.

- Biometric Security: Enhancing security with fingerprint scanning, facial recognition, or voice authentication—as part of a two-factor authentication process—ensures users feel safe while keeping the login process seamless.

- Data Visualization Tools: Simplifying financial data with interactive charts and graphs helps users grasp their financial status at a glance, making it easier to track and plan.

- Voice Interface Capabilities: For those always on the move, voice-activated commands offer hands-free access to banking functions, bringing convenience to a whole new level.

Why Choose Euvic Inc.? Leading In Fintech & Banking App Development Solutions

When it comes to fintech and banking app development, Euvic Inc. stands out as a leader, combining cutting-edge technology with industry expertise. With over 19 years of experience and a global presence, Euvic is uniquely positioned to deliver top-tier software solutions tailored to the needs of financial institutions. Here’s why Euvic should be your go-to partner for fintech and banking app development:

Centers Of Excellence At Euvic — Your Competitive Edge

At Euvic, our clients benefit from access to our numerous Centers of Excellence (CoE), each offering specialized expertise designed to meet individual project needs.

This approach allows us to provide deep expertise across a broad range of solutions. In fintech & banking software development, we frequently tap into the capabilities of our CoE, Artkai, renowned for its excellence in user experience design and technology integration. This collaboration enables us to deliver exceptional digital experiences that resonate with end-users and align with our clients’ strategic goals.

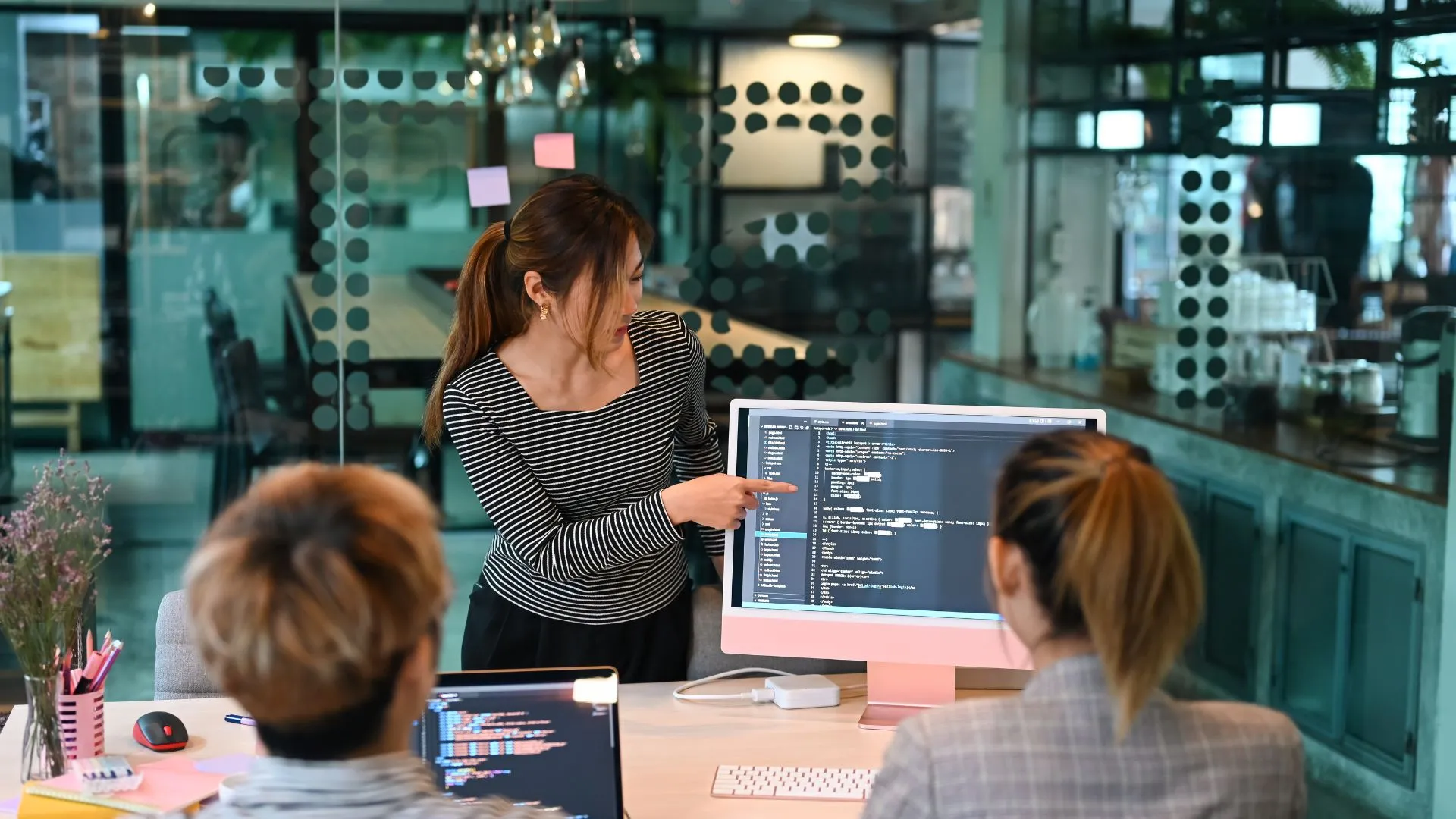

The strength of our approach lies in our ability to assemble a ‘Dream Team’ for every project, leveraging the specialized skills within our Centers of Excellence. For fintech & banking apps, this means utilizing our top-tier UX/UI design team from Artkai to create user-centric solutions that offer an intuitive and engaging experience.

Exceptional Software Engineering

Euvic blends the world-renowned expertise of Polish & Ukrainian engineers with the strategic acumen of US-based leadership. This unique combination allows us to provide high-quality, scalable solutions while maintaining close communication and understanding of local market needs. Our engineers rank among the top 3 globally in competitive coding challenges, ensuring that your project benefits from the best talent available.

End-To-End Service

With Euvic, you get more than just a service provider; you gain a partner that can handle your entire project from concept to delivery. Our team of 6000+ skilled engineers across more than 100 specialized teams is equipped to tackle any challenge. Whether you need a new product vision, feature integration, or a complete platform overhaul, Euvic’s comprehensive service offering covers it all.

Scalable And Cost-Efficient Solutions

In the fast-paced world of fintech, scalability and cost-efficiency are crucial. Euvic’s Smart Delivery Model allows us to scale your software development efforts seamlessly, adapting to your needs without unnecessary overhead. Our approach reduces time-to-market and lowers risks, giving you a competitive edge in the financial industry.

Proven Success In Fintech & Banking

Euvic has a proven track record of delivering successful projects in the fintech & banking sectors. From complex system integrations to developing user-friendly mobile apps, we’ve done it all. Our experience with over 1,000 successful client projects means we understand the unique challenges of fintech and know how to overcome them.

Why Euvic For Your Banking App Or Fintech Project?

- Local Expertise With Global Talent: US-based leadership combined with top-ranked Polish engineers.

- Comprehensive Services: From consulting to deployment, we manage your entire project.

- Scalability: Easily scale your project as your needs evolve.

- Proven Track Record: Hundreds of successful client projects in fintech & banking.

- Cost Efficiency: High-quality solutions at a competitive price point.

Choosing Euvic means partnering with a team that understands the intricacies of fintech & banking app development. We bring the expertise, experience, and dedication needed to help you achieve your business goals.

Now, let’s explore the top 5 companies leading the charge in fintech design, setting the benchmark for what a truly exceptional fintech experience looks like.

Case Study 1: DNA Payments — Redesigning Seamless Merchant Payment Ecosystems

The Challenge:

DNA Payments Group is a leading omnichannel payments provider in the UK and EU, supporting over 65,000 merchants with solutions for online, in-store, and mobile transactions. Established in 2018, they offer an integrated payment platform that includes features for seamless merchant onboarding, real-time transaction monitoring, and multi-channel payment management.

DNA Payments needed to transform its existing merchant payment portal into a more user-friendly and scalable platform. The original interface was confusing, leading to low user engagement and high churn rates. The absence of a mobile version further restricted users from managing payments on the go, making the platform less attractive to potential and existing users.

The Solution:

We undertook a comprehensive redesign of the DNA Payments platform, focusing on creating a consistent and intuitive user experience across both desktop and mobile devices. Our team streamlined the onboarding process by reducing the number of steps required, standardizing the UI, and adding features like a wizard progress tracker. Additionally, we introduced new functionalities such as the Virtual Terminal and advanced payment methods management, enabling users to accept and manage payments more efficiently.

New Design Features:

- Simplified Onboarding: Reduced the number of steps for user registration, making the process quicker and more intuitive.

- Unified Interface: Standardized the user interface across devices, ensuring a seamless experience whether on desktop or mobile.

- Advanced Payment Management: Introduced a Virtual Terminal and payment methods management, improving efficiency in transaction handling.

The Result:

Our redesign of the DNA Payments platform led to significant improvements in user engagement and operational efficiency. By simplifying the onboarding process, standardizing the user interface across devices, and adding new features, the platform experienced a substantial increase in user adoption and satisfaction.

Key Outcomes Achieved:

- 18% increase in new user growth during the first few months after the platform’s relaunch.

- 2.3x reduction in churn rate within the first two weeks of user engagement.

- £900 million processed monthly through the platform, highlighting its scalability and effectiveness.

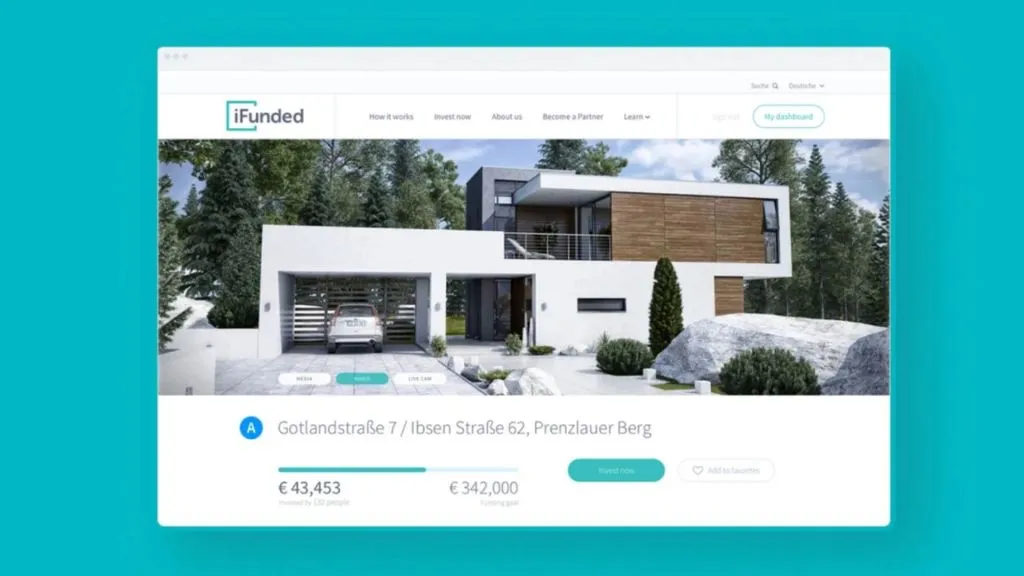

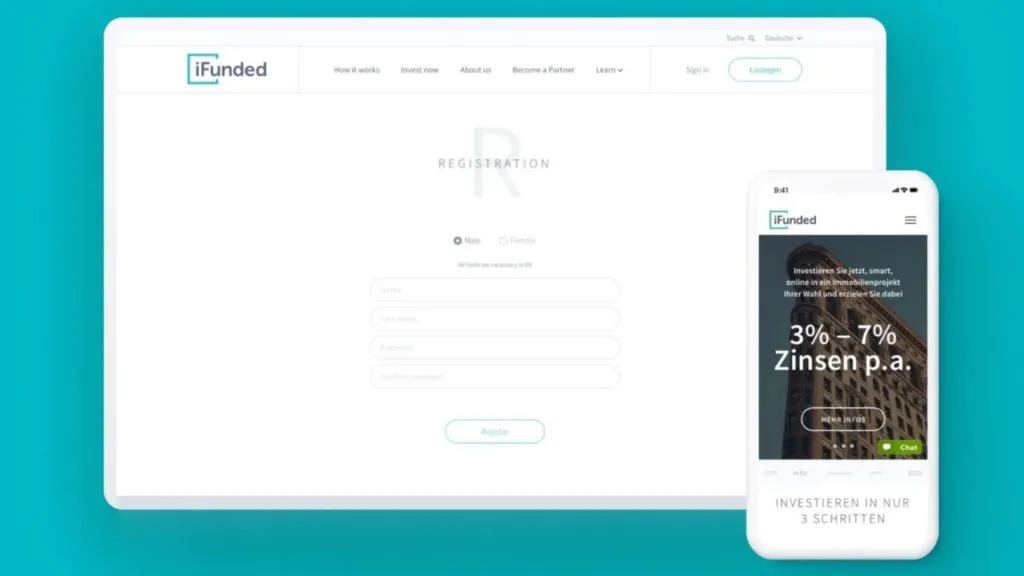

Case Study 2: iFunded — Streamlining Real Estate Investments With User-Friendly Design

The Challenge:

iFunded, a German startup aiming to democratize real estate investments, sought to create an online marketplace that catered to both private and institutional investors. The primary challenge was to design and develop a platform that was not only user-friendly but also compliant with the strict regulations of the German market. Additionally, iFunded needed to establish a strong brand identity that would foster trust and credibility among investors in a market where such a digital product was previously non-existent.

The Solution:

We collaborated with iFunded to build a sophisticated and intuitive platform from the ground up through our one of our Centers of Excellence, Artkai. Our approach began with in-depth research, which informed the creation of smooth user flows tailored to both private and institutional investors. The platform was designed to be minimalistic and easy to navigate, offering a seamless investment process from registration to the personalized investor dashboards. We integrated features such as real-time access to investment updates, educational resources about the German real estate market, and a comprehensive deals overview with investment return forecasts. Additionally, we developed a mobile version of the platform, ensuring a consistent and distraction-free experience across all devices.

New Design Features:

- User-Centric Design: Developed smooth user flows for both private and institutional investors, enhancing ease of use.

- Real-Time Updates: Integrated real-time investment updates directly into the dashboard, keeping investors informed at all times.

- Mobile Consistency: Created a mobile version that mirrors the desktop experience, maintaining functionality and ease of navigation.

The Result:

Our partnership with iFunded led to the successful launch of a unique digital platform that has made global real estate investments accessible, simple, and transparent. The platform’s user-friendly design and streamlined processes significantly simplified what was once a complex and stressful investment process.

Key Outcomes Achieved:

- 18 real estate projects successfully funded through the platform.

- €90 million in total project volume managed via the platform.

- €18 million in raised capital, demonstrating the platform’s effectiveness in attracting and securing investor funds.

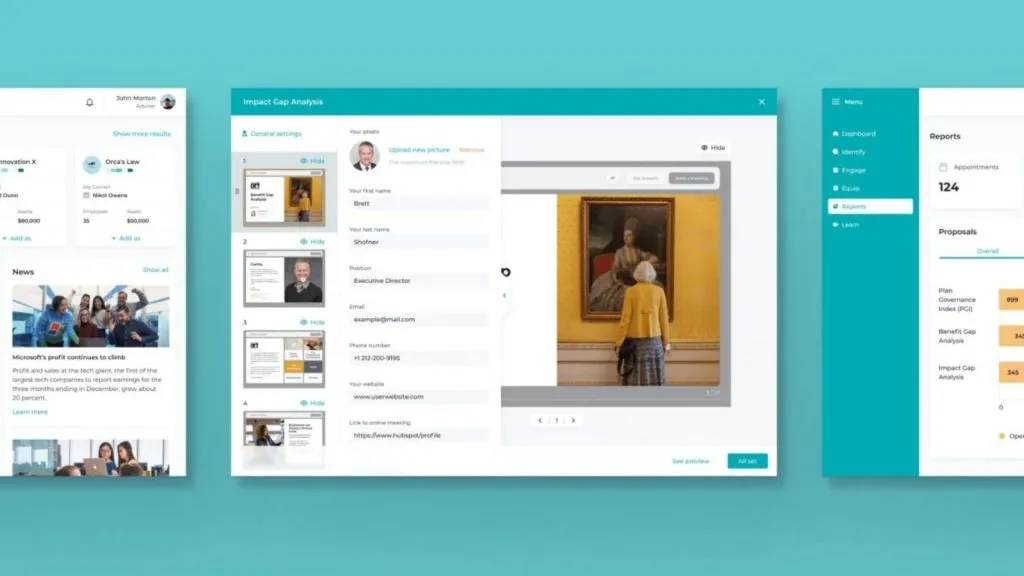

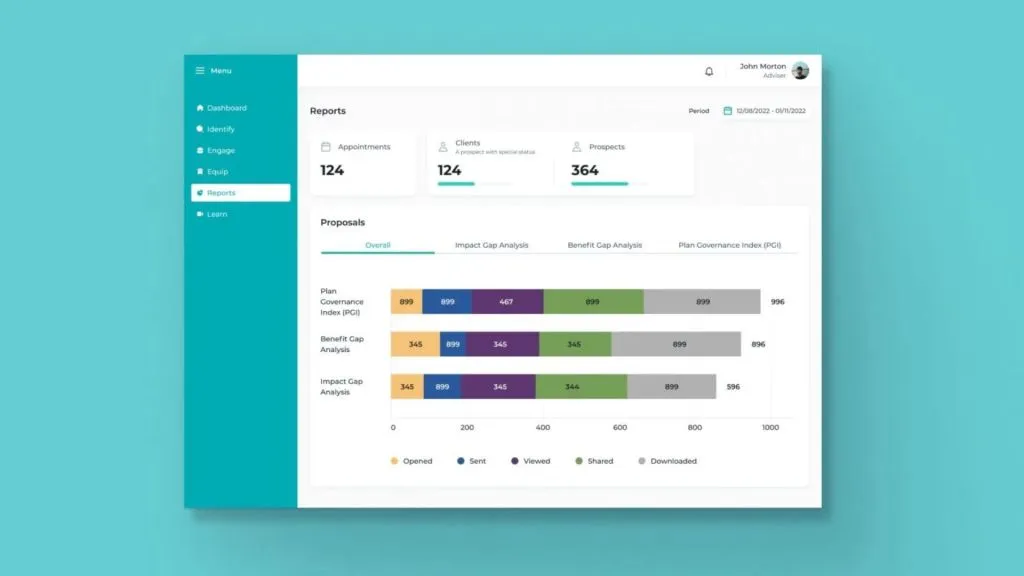

Case Study 3: Automated Solutions For Retirement Advisors

The Challenge:

A leading platform aimed at supporting retirement advisors in the USA sought to tackle significant challenges in the industry. Retirement advisors often grapple with the tedious and time-consuming process of gathering company information and manually creating personalized retirement proposals. The traditional methods were inefficient, involving multiple tools and outdated systems, which hindered productivity. The platform aimed to streamline this process by automating proposal generation, integrating essential third-party services, and providing tools to enhance transparency and personalization in retirement planning.

The platform’s executives sought to address the significant challenges faced by retirement advisors in the U.S., who often struggle with the cumbersome process of gathering company information and manually creating tailored retirement proposals. The existing methods were time-consuming and inefficient, often involving multiple tools and outdated systems. They aimed to streamline this process by creating a comprehensive platform that could automate proposal generation, integrate essential third-party services, and offer tools to enhance transparency and personalization in retirement planning.

The Solution:

We collaborated with the platform’s team to develop a solution that would dramatically reduce the manual workload for retirement advisors and boost their productivity. Our team began by designing advanced search functionality, enabling advisors to filter companies based on specific criteria and save these filters for future use. We also implemented an automated prospecting feature that consolidated company data onto a single page, automatically analyzing it according to the advisor’s needs.

A key component of the platform is its proposal generation feature, which allows advisors to create fully branded and customizable proposals, complete with interactive ROI calculators and voice-over capabilities for personalized presentations. Additionally, we integrated essential third-party services, including the Form 5500 Series, ERISApedia, and Apollo, to equip advisors with comprehensive, up-to-date data and compliance tools.

The Result:

Our collaboration resulted in a powerful platform that revolutionized the retirement planning process for advisors. Within its first few months, the platform onboarded several hundred retirement consultants, demonstrating its effectiveness in the industry.

Key Outcomes Achieved:

- Over 1,500 proposals auto-generated within six months of the platform’s launch.

- A 2.5x reduction in the time it takes to move from identifying a prospect to creating a tailored proposal.

- Significant improvements in advisor productivity, leading to better service for thousands of companies and their employees.

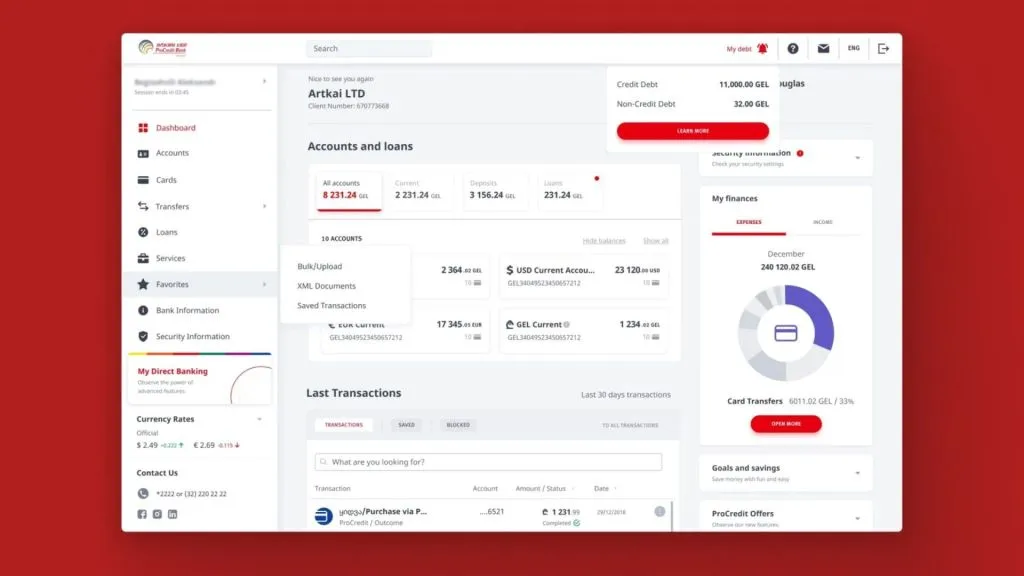

Case Study 4: ProCredit Bank — Enhancing Financial Control Through Intuitive Digital Platforms

The Challenge:

ProCredit Bank, a member of the ProCredit Group, sought to transition from traditional banking methods to a fully digital platform. Operating across South Eastern and Eastern Europe, South America, and Germany, the bank needed a solution that would reduce the reliance on physical branches, simplify the onboarding process, and offer a consistent and efficient digital experience for their clients. The primary goal was to provide small and medium-sized businesses, as well as individual clients, with a platform that allowed them to manage their finances easily and securely, while also maintaining a high level of user control and personalization.

The Solution:

We collaborated with ProCredit Bank to develop an integrated digital banking platform that addressed the diverse needs of their clients. The project began with an extensive research phase, which included interviews and usability tests to identify user pain points and preferences. Our design and development process focused on creating a seamless experience across both web and mobile platforms.

New Design Features:

- Unified Dashboard: Consolidated all key banking functions onto a single screen, providing users with a comprehensive view of their accounts and transactions.

- Customizable Navigation: Developed a Favorites feature that allows users to personalize their navigation menu, facilitating quick access to frequently used tools.

- Seamless Onboarding: Integrated Video Identification tools into the onboarding process, enabling clients to open accounts remotely without the need for branch visits.

The Result:

The overhaul of ProCredit Bank’s digital platform significantly improved user satisfaction and operational processes. Clients now enjoy a more seamless experience across both web and mobile platforms, with streamlined workflows that allow them to manage their finances more efficiently. The introduction of customizable features has empowered users to tailor their banking interface to their specific needs, enhancing the overall user experience. Furthermore, the platform’s enhanced security features and ease of access have increased client confidence in managing their accounts digitally, contributing to a more user-centric banking environment.

Key Outcomes Achieved:

- 99% of eligible banking services now performed online.

- 1.5x faster transfer times through the web and mobile banking app.

- 60%+ reduction in time needed to block a card via the mobile app.

- 2x faster login times in the mobile app compared to the previous version.

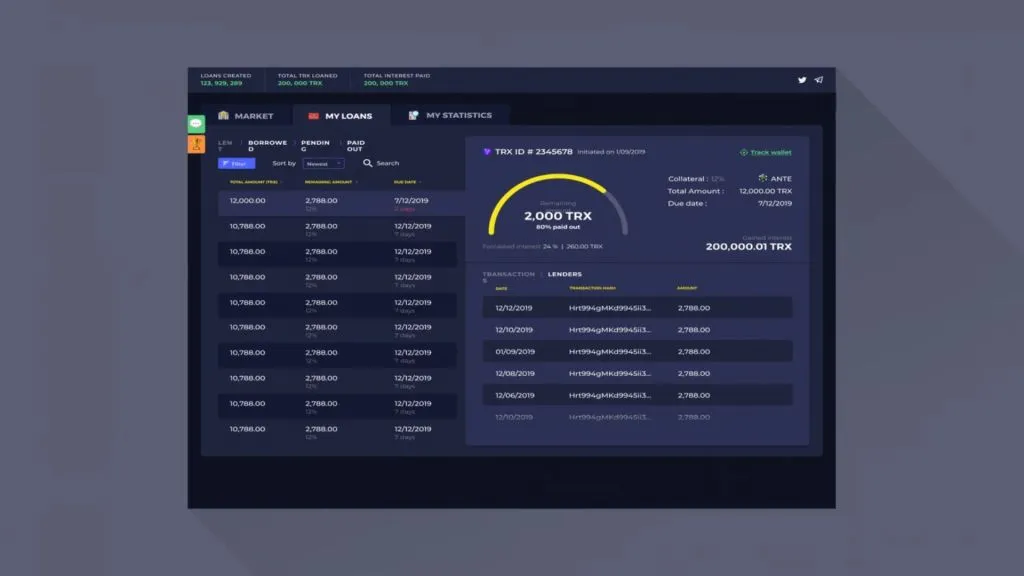

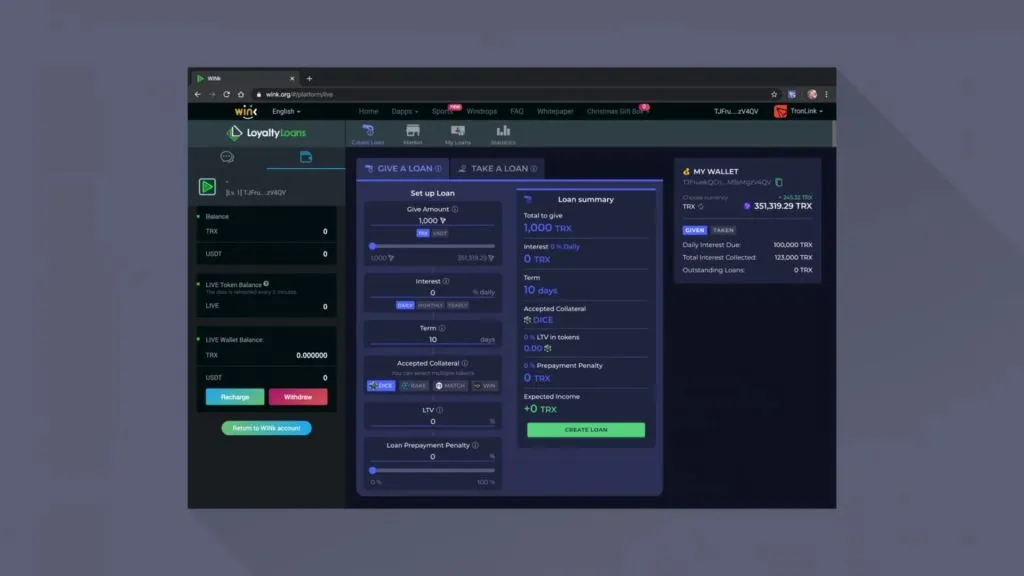

Case Study 5: Loyalty Loans – Secure, Digital Asset-Backed P2P Loan Platform For TRON Ecosystem

The Challenge:

Loyalty Loans is a blockchain-based P2P loan platform designed for TRON dApps, enabling crypto holders to leverage their digital assets as collateral to access fiat money. The platform combines the security of traditional finance with the innovation of blockchain, offering users the ability to borrow and lend with favorable terms and integrated marketplace opportunities.

Loyalty Loans sought to develop a digital platform allowing crypto holders to secure fiat loans by using their digital assets as collateral. The platform needed to balance the stringent security demands of traditional finance with the innovative nature of blockchain technology. Additionally, it had to be user-friendly and scalable, integrating seamlessly with the TRON ecosystem to serve a diverse user base.

The Solution:

We partnered with Loyalty Loans to bring their vision to life. We began the project with a thorough research phase, gaining a deep understanding of the specific needs within the fintech and blockchain sectors. Following this, our team designed and developed a responsive web-based solution that incorporated advanced security features like multi-signature wallets and cold storage. We built the platform with scalability in mind, making sure it could accommodate a growing user base while remaining easy to use. Integration with the TRON ecosystem was facilitated through a straightforward API, broadening the platform’s accessibility to a wide range of dApps.

Key Design Features:

- Enhanced Security: Implemented multi-signature wallets and cold storage, providing a secure environment for digital assets.

- User Scalability: Designed the platform to scale effortlessly, accommodating an expanding user base without compromising performance.

- TRON Integration: Developed a straightforward API for seamless integration with the TRON ecosystem, enhancing accessibility.

The Result:

Our collaboration resulted in a sophisticated P2P loan platform that successfully bridges the gap between digital and traditional finance. Loyalty Loans now provides a secure, scalable, and user-friendly environment where users can borrow fiat money against their digital assets without selling them. The platform’s seamless integration with the TRON ecosystem has expanded its reach, allowing it to cater to a broader audience. Moreover, users benefit from favorable loan terms and the opportunity to earn interest by lending their assets, all within a secure and transparent framework.

How To Increase The Impact Of Your Banking Or Fintech Design

Designing a banking or fintech platform requires more than just a visually appealing interface. It demands a thoughtful approach that balances user experience, security, and scalability. Here’s how to ensure your design not only meets but exceeds user expectations.

Step 1: Prioritize User-Centered Design

Focus on creating intuitive pathways that allow users to perform tasks effortlessly and minimize friction.

Step 2: Incorporate Advanced Security Features

Implement biometric authentication and encryption to build user trust while maintaining a seamless experience.

Step 3: Ensure Responsive Design Across Devices

Design with adaptability in mind, ensuring a consistent and efficient experience on mobile, tablet, and desktop.

Step 4: Leverage Data Visualization

Use interactive charts and graphs to present complex financial data in a clear, easily digestible format.

Step 5: Integrate AI-Powered Support

Enhance customer service with AI chatbots that provide instant assistance, boosting user satisfaction and retention.

Step 6: Focus on Accessibility

Create a platform that is inclusive and easy to use for all users, regardless of their abilities, ensuring wider adoption.

Step 7: Test and Iterate Continuously

Regularly test your design with real users, gather feedback, and make iterative improvements to stay ahead of the competition.

Get In Touch With The Top Banking & Fintech Design Partners At Euvic

When it comes to banking & fintech design, the difference between good and great lies in the expertise of your partner. Euvic stands at the forefront of this industry, combining world-class Polish engineering talent of 6000+ software engineers with strategic, US-based leadership to deliver top-tier solutions tailored to your specific needs.

With thousands of delivered projects and partnerships with industry leaders like Swedbank, InterLINK, and Fortis Bank, Euvic is uniquely positioned to transform your digital vision into reality. Our approach is simple yet powerful: we bring together specialized teams that understand your challenges and work tirelessly to overcome them, ensuring your fintech platform not only meets but exceeds market expectations.

As a trusted partner, Euvic offers more than just technical expertise—we provide a seamless blend of innovation, security, and scalability that empowers your business to grow and thrive in an increasingly competitive landscape. Whether you’re looking to develop a new product, modernize your tech stack, or integrate cutting-edge AI, Euvic has the experience and dedication to get you there.

Ready to elevate your banking or fintech platform? Get in touch with Euvic today. Let’s create something extraordinary together.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Euvic is a competitive advantage for us. The technical excellence that Euvic has brought is not easily matched and their support has become integral to our growth strategy.

Talk to Your Local Euvic Team

.webp)